GreenTech und ClimateTech als Schlüssel zu mehr Nachhaltigkeit - eine umfassende Übersicht

Der Klimawandel stellt die größte Herausforderung unserer Zeit dar. Moderne Technologien und Lösungen bieten jedoch die Chance, einen Beitrag zu deren Überwindung zu leisten, indem sie auf Innovation für eine nachhaltige Entwicklung setzen. Diese Technologien können dabei helfen, CO₂-Emissionen zu reduzieren, Ressourcen effizienter zu nutzen und umweltfreundliche Alternativen zu fördern. GreenTech- und ClimateTech-Technologien spielen hierbei eine zentrale Rolle.

Durch den Einsatz von GreenTech und ClimateTech können wir nicht nur die negativen Auswirkungen des Klimawandels abmildern, sondern auch neue Wege finden, um unsere Wirtschaft und Gesellschaft nachhaltig und zukunftsfähig zu gestalten. ClimateTech-Startups sind Vorreiter dieser Transformation. Durch die Implementierung fortschrittlicher Hard- und Software und die Förderung umweltfreundlicher Innovationen tragen sie wesentlich zum globalen Klimaschutz bei.

Als weltweit operierendes Softwareentwicklungsunternehmen unterstützen wir zukunftsorientierte Unternehmen bei Vention dabei, Ihre innovativen ClimateTech- und GreenTech-Projekte erfolgreich umzusetzen. Dieser Beitrag bietet Ihnen einen umfassenden Überblick über die wichtigsten Entwicklungen, Herausforderungen und Zukunftsaussichten in diesem wachsenden Sektor.

ClimateTech: Eine Einführung

ClimateTech ist ein Sammelbegriff, der verschiedene Klimaschutz-Technologien umfasst. Dazu gehören Software und Hardware, die speziell darauf abzielen, die Auswirkungen des Klimawandels zu mindern und die globale Erwärmung zu bekämpfen.

Beispiele für relevante Technologien und Lösungen im Bereich ClimateTech

|

Lösungen |

Kurze Beschreibung |

Mögliche Softwarekomponenten |

|

Erweiterte geothermische Systeme |

Nachhaltige Alternative zu fossilen Brennstoffen, die aus Erdwärme Energie gewinnt. |

|

|

Wärmepumpen |

Verbrauchen weniger Energie und reduzieren CO₂-Emissionen. |

|

|

Offshore-Windenergie |

Bietet erhebliches Potenzial zur Energiegewinnung ohne Landverbrauch. |

|

|

CO₂-Abscheidung und -Nutzung (auf Englisch "carbon capture and utilization", abgekürzt CCU) |

Filtern und Speichern von CO₂ aus der Atmosphäre für geringere Treibhausgasbelastung. |

|

|

Grüner Wasserstoff |

Kann fossile Brennstoffe in vielen Anwendungen ersetzen. |

|

|

Batterietechnologien |

Technologische Fortschritte unterstützen die Integration erneuerbarer Energien. |

|

|

Elektrofahrzeuge |

Ohne den Verbrauch fossiler Brennstoffe trägt E-Mobilität zur Reduzierung von CO₂-Emissionen bei. |

|

|

Intelligente Stromnetze (Smart Grids) |

Smarte Überwachung und Steuerung von Stromverteilung und -verbrauch in Echtzeit. |

|

|

Energieeffiziente Gebäudetechnologien |

Optimierung des Energieverbrauchs in Gebäuden. |

|

|

Autonome Agrarroboter |

Ermöglichen präziser, ressourcenschonender Landwirtschaft. |

|

|

Green Finance |

Förderung nachhaltiger, klimafreundlicher Projekte und Investitionen. |

|

ClimateTech: IT-Expertise für zukunftssichere Lösungen

Hinter so gut wie jeder ClimateTech-Lösung steht eine smarte Kombination von innovativen IT-Technologien, die es ermöglichen, komplexe Umweltprobleme effizient zu adressieren und gleichzeitig nachhaltige Geschäftsmodelle zu fördern. Diese IT-Lösungen treiben die Entwicklung von Produkten und Dienstleistungen voran, die sowohl ökologisch als auch ökonomisch sinnvoll sind:

- Entwicklung maßgeschneiderter Software: Lösungen, die speziell auf die Bedürfnisse von Startups und Betrieben im ClimateTech-Sektor zugeschnitten sind, um deren Effizienz und Effektivität zu steigern.

-

Spezifische IoT-Lösungen: Einsatz des Internets der Dinge (IoT) ermöglicht die Überwachung und Steuerung von Energieverbrauch und -effizienz in Echtzeit.

-

Tiefgehendes Verständnis von Cloud-Technologien: Bereitstellung skalierbarer, sicherer und flexibler Cloud-Lösungen zur Unterstützung zielführender ClimateTech-Lösungen.

-

Cybersicherheit-Expertise: Cybersicherheit ist für den ClimateTech-Sektor entscheidend, da sie den Schutz kritischer Infrastrukturen gewährleistet, die für die Bekämpfung des Klimawandels und die Förderung nachhaltiger Technologien unerlässlich sind.

-

Blockchain-Know-how: Blockchain-Technologie wird zunehmend für größere Transparenz und Vertrauen in CO₂-Handelssystemen und nachhaltigen Lieferketten genutzt.

-

Big Data Analytics: Unverzichtbar für die Analyse großer Datenmengen, um Zusammenhänge zu verstehen, Muster zu erkennen, präzise Vorhersagen zu treffen und datengetriebene Entscheidungen zu ermöglichen.

- KI-Fachwissen: Einbeziehung von KI-Fachleuten, die Geschäftsmodelle und Anforderungen umfassend einordnen können und zudem das Potenzial von KI-Anwendungen optimal ausschöpfen können.

„Künstliche Intelligenz (KI) ist zentral in der Entwicklung und Implementierung von ClimateTech-Lösungen", so Technical Consultant und Vention-Contractor, Alex Skomyanov. „KI analysiert große Datenmengen, erkennt Muster und trifft Vorhersagen, die zur Optimierung von Energieverbrauch, Emissionen und Ressourceneffizienz beitragen. Dabei ist wichtig, wie ein Kunde die Daten aus seinen Operationen sammelt. Dafür können wir Data Engineering-, DevOps- sowie MLOps-Expertise als Lösung anbieten. KI und ML sind das Ergebnis einer intelligenten Datensammlung und statistischen Analyse, die ohne Daten nicht existieren kann. Anwendungen reichen von intelligenten Energiemanagementsystemen und vorausschauender Wartung bis hin zu optimierten Logistik- und Lieferkettenprozessen", führt Alex Skomyanov weiter aus. „Durch den Einsatz von KI können Unternehmen ihre Nachhaltigkeitsziele schneller und effizienter erreichen. Investitionen in KI-Technologien und die Zusammenarbeit mit Technologieunternehmen helfen dabei, das volle Potenzial von KI im ClimateTech-Sektor auszuschöpfen."

Sie benötigen umfassende IT-Expertise für den ClimateTech-Sektor?

Unsere Fachleute beraten und begleiten Sie bei jedem Schritt Ihres Vorhabens.

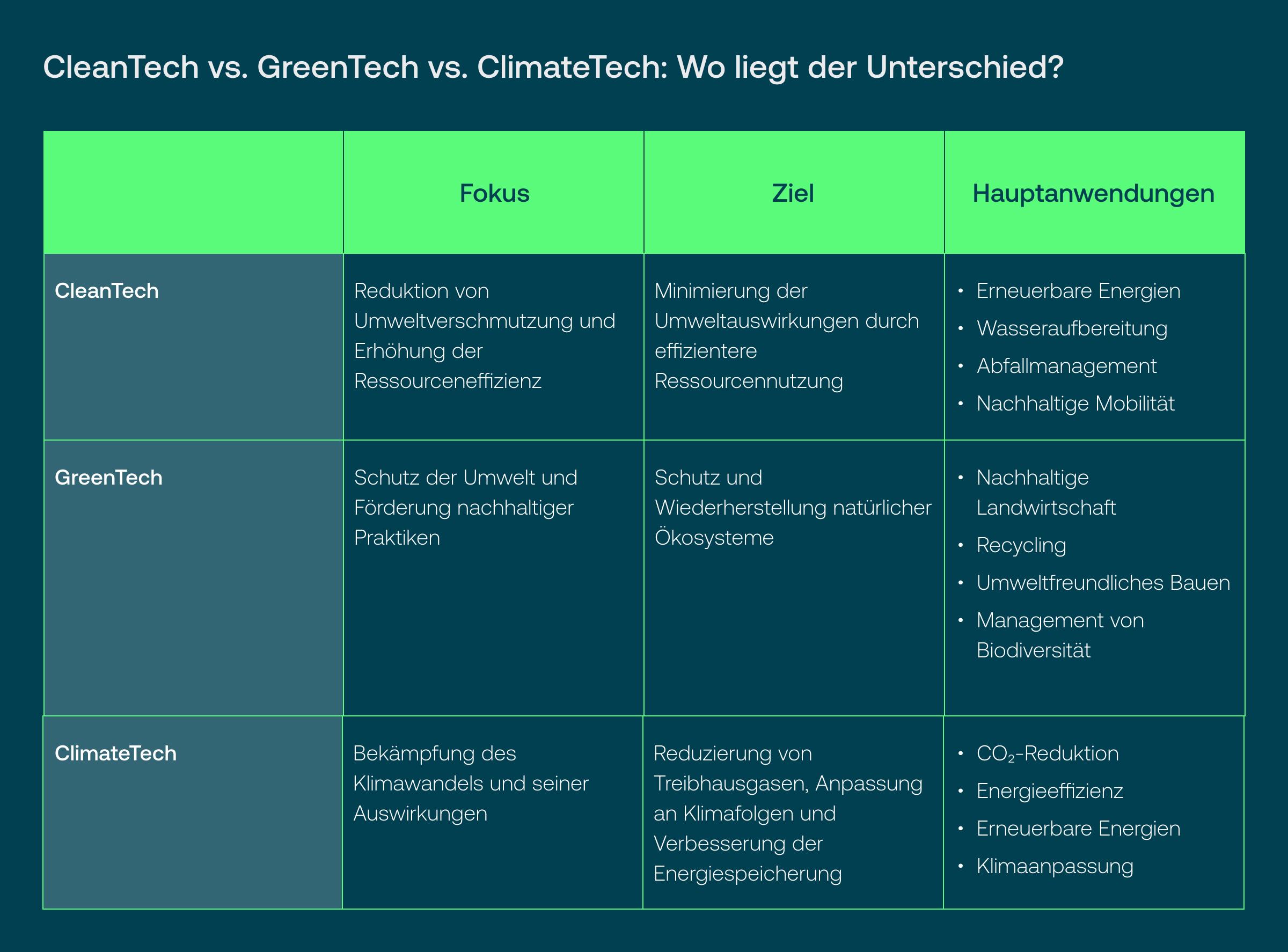

CleanTech vs. GreenTech vs. ClimateTech

Im Bereich der umweltfreundlichen Technologien sind die Begriffe CleanTech, GreenTech und ClimateTech häufig zu hören. Sie werden oft synonym verwendet, doch es gibt feine Unterschiede in ihrer Bedeutung und ihrem Anwendungsbereich.

CleanTech

CleanTech, kurz für "Clean Technology", gewann in den frühen 2000er Jahren an Bedeutung. Der Begriff bezieht sich auf Technologien, die darauf abzielen, die Umweltverschmutzung zu reduzieren und die Ressourceneffizienz zu erhöhen. CleanTech umfasst eine breite Palette von Anwendungen wie erneuerbare Energien, Wasseraufbereitung, Abfallmanagement und nachhaltigen Transport.

Das Hauptziel von CleanTech ist es, die Umweltauswirkungen menschlicher Aktivitäten zu minimieren und gleichzeitig die Effizienz bei der Nutzung natürlicher Ressourcen zu maximieren.

GreenTech

GreenTech, oder "Green Technology", wird oft synonym mit CleanTech verwendet, hat jedoch einen spezifischeren Fokus auf den Schutz und die Wiederherstellung der natürlichen Umwelt. Der Begriff bezieht sich auf Technologien, die direkt zur Erhaltung und Wiederherstellung der Natur beitragen. Dies schließt nachhaltige Landwirtschaft, Recycling, umweltfreundliches Bauen und das Management der Biodiversität ein.

GreenTech zielt darauf ab, die natürlichen Ökosysteme zu schützen und die Umwelt nachhaltig zu bewirtschaften.

ClimateTech

ClimateTech oder Klimatechnologien sind relativ neue Begriffe, die um 2020 populär wurden. Sie beschreiben Technologien, die speziell darauf ausgerichtet sind, die Auswirkungen des Klimawandels zu bekämpfen. Diese Technologien konzentrieren sich auf die Reduktion von Treibhausgasemissionen, die Anpassung an Klimafolgen, die Nutzung erneuerbarer Energien und die Verbesserung der Energiespeicherung.

Das Hauptziel von ClimateTech ist es, den Klimawandel durch die Reduzierung der Treibhausgase und die Förderung nachhaltiger Praktiken zu bekämpfen und gleichzeitig die Widerstandsfähigkeit gegenüber vorhandenen Klimafolgen zu erhöhen.

Für grüne Unternehmen lohnt es sich, jede dieser Strategien zu beachten, um ihre Nachhaltigkeit zu steigern. Auch wenn es einige Unterschiede in diesen Definitionen gibt, bedeuten sie im Großen und Ganzen das Gleiche: Technologien mit positiven Auswirkungen auf das Klima. Inzwischen ist der Begriff ClimateTech sowohl bei Investoren als auch bei Startups weit verbreitet.

Globale Marktdynamik

Der ClimateTech-Sektor wächst rasant und beeinflusst weltweit eine Vielzahl von Industrien, darunter die Energiewirtschaft, das Bauwesen, den Verkehr und die Mobilität sowie das Wasser- und Abfallmanagement. Diese Dynamik wird von zahlreichen Faktoren bestimmt, darunter technologische Innovationen, regulatorische Rahmenbedingungen, Investitionen in nachhaltige Lösungen und ein steigendes Bewusstsein für den Klimaschutz. Die kontinuierliche Entwicklung neuer Technologien und die verstärkte globale Zusammenarbeit treiben diesen Sektor voran und schaffen neue Möglichkeiten für nachhaltiges Wirtschaften.

Größe und Wachstum des Marktes – global und im DACH-Raum

Der globale ClimateTech-Markt wächst schnell und hat sich zu einem wichtigen Sektor entwickelt. Der Marktwert wurde 2023 auf etwa 20,34 Milliarden US-Dollar geschätzt und soll laut Future Market Insights bis 2033 auf etwa 150,12 Milliarden Dollar ansteigen, was einer durchschnittlichen jährlichen Wachstumsrate von 24,5 % entspricht.

“Die DACH-Region ist ein bedeutender und wachsender Markt für ClimateTech-Technologien”, sagt Joris Hecher, Business Development Manager bei Vention. “Die DACH-Länder haben sich durch ihre politischen Maßnahmen, Investitionsförderungen und eine aktive Startup-Szene als Vorreiter im Bereich der Klimaschutztechnologien etabliert”, führt Hecher weiter aus. “Nicht zu unterschätzen sind in diesem Zusammenhang auch die Präferenzen der Endkunden: So achten laut einer PwC-Umfrage sechs von zehn Verbrauchern beim Kauf von Produkten auf Nachhaltigkeit. Bei den unter 35-Jährigen ist dieser Anteil mit 67 % noch deutlich höher – was das Wachstumspotenzial verdeutlicht”, schließt Joris Hecher den Einblick in den DACH-Markt ab.

-

Deutschland ist der größte Markt für ClimateTech in der DACH-Region und trägt etwa 10,4 % zum globalen ClimateTech-Markt bei. Treiber des deutschen Marktes sind das starke Engagement der Regierung und die Vielzahl an Startups. Im ersten Halbjahr 2024 stieg das Volumen der Risikokapitalinvestitionen in deutsche Startups um 363 Millionen Euro (zwölf Prozent) auf 3,4 Milliarden Euro, was auf eine mögliche Trendwende nach den Rückgängen in den beiden Vorjahren hindeutet. Trotz dieses positiven Gesamttrends ging die Anzahl der Finanzierungsrunden jedoch deutlich zurück, auf 367 Deals – 19 Prozent weniger als im Vorjahr.

-

In Österreich gibt es 193 ClimateTech-Startups, die von umfassenden staatlichen Förderprogrammen profitieren. Eine aktuelle Studie von Frontier Economics und dem Austrian Institute of Technology beziffert die für eine erfolgreiche Klimawende notwendigen Investitionen in die Netzinfrastruktur bis zum Jahr 2030 auf ca. 15,2 Milliarden Euro. Österreichs Klimaplan sieht vor, dass bis 2030 100 % des Stroms aus erneuerbaren Quellen stammen sollen.

-

Die Größe des ClimateTech-Markts in der Schweiz bis 2029 wird auf 1,2 Milliarden Schweizer Franken geschätzt, mit einem starken Wachstumspotenzial aufgrund der Unterstützung durch staatliche und private Investoren. Der Fokus der Schweizer ClimateTech-Unternehmen liegt auf erneuerbaren Energien, Energieeffizienz und CO₂-Reduktion.

Investitionstrends

Das internationale Wirtschaftsprüfungsunternehmen PwC hat während 2021 und 2022 hohe Investitionen verzeichnet. 2023 gab es einen Rückgang der Deal-Aktivitäten um 14 %. Dennoch bleibt der ClimateTech-Sektor relativ widerstandsfähig, unterstützt durch staatliche Anreize und eine zunehmende Sensibilisierung für Klimarisiken. Laut Statista sind im Jahr 2023 Energie und Transport die Sektoren mit den meisten ClimateTech-Venture-Finanzierungen. Während der Transportsektor im ersten Quartal 2023 mit einer Summe von 2,5 Milliarden US-Dollar die globalen Investitionen in ClimateTech-Ventures dominierte, übernahm der Energiesektor im zweiten Quartal die Führung.

Ein auffälliger Trend ist der Anstieg der Investitionen in Technologien zur CO₂-Abscheidung, -Nutzung und -Speicherung. Diese Kategorie hat als einzige in den letzten zwei Jahren einen absoluten Anstieg der Investitionen verzeichnet, angetrieben durch Verpflichtungen großer Unternehmen und staatliche Investitionen.

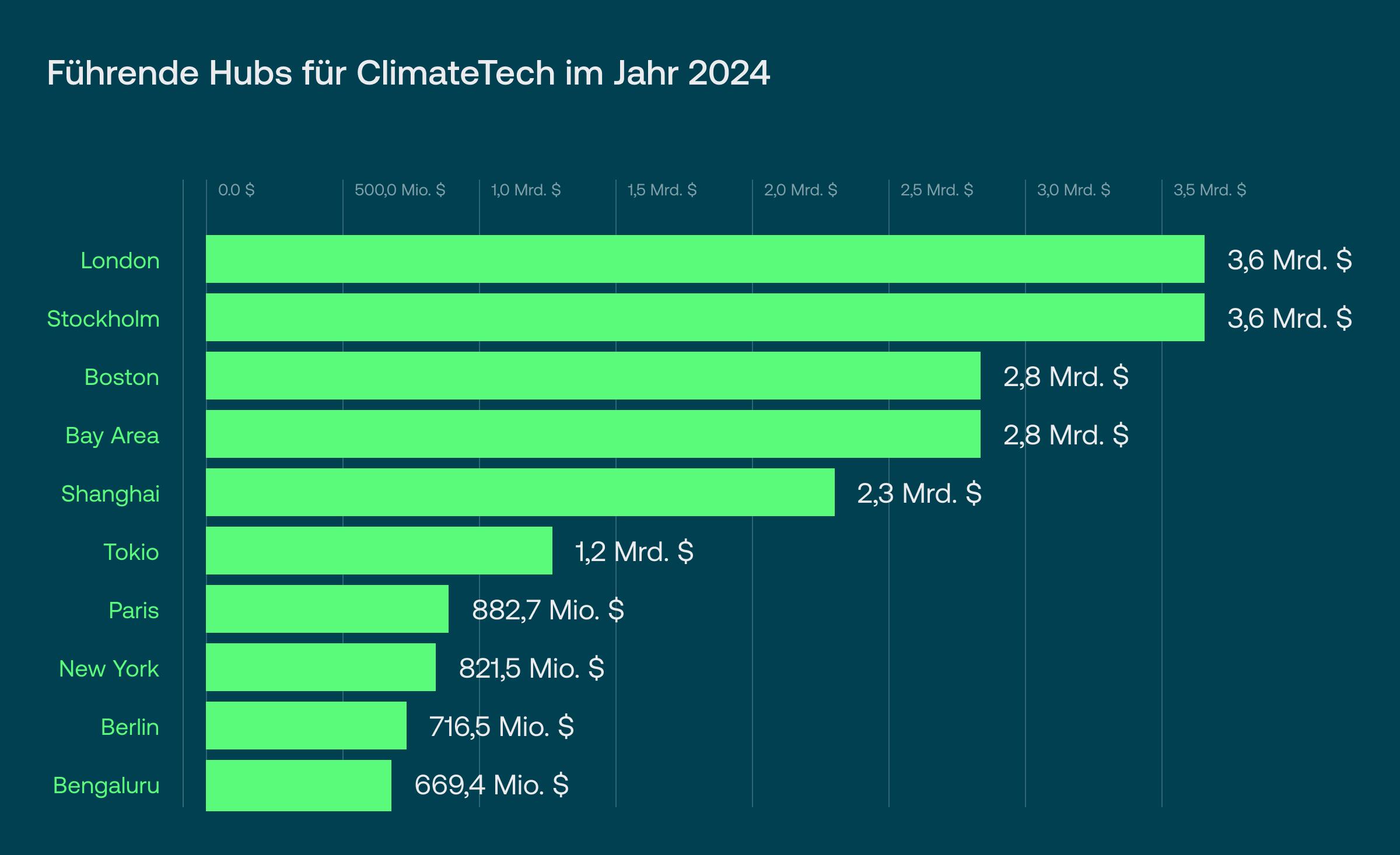

Insgesamt haben die USA seit 2018 131 Mrd. USD in ClimateTech-Startups investiert, 2,4-mal mehr als China. Großbritannien, Schweden, Deutschland und Frankreich folgen mit 11-18 Mrd. USD an Finanzmitteln.

Kumulativ haben die USA seit 2018 vier der sieben wichtigsten Hubs für sich beansprucht, nur Shanghai in Asien und Stockholm und London in Europa liegen auf den Plätzen drei, fünf und sechs. Paris, Peking und Berlin folgen dicht dahinter.

Quelle: Dealroom.co

Regulatorische Landschaft

Im Fall der USA tragen Gesetze wie der Inflation Reduction Act dazu bei, Investitionen in erneuerbare Energien und andere klimafreundliche Technologien zu fördern. In Deutschland und anderen europäischen Ländern setzen die Regierungen auf ambitionierte Klimaziele und umfangreiche Förderprogramme, um die Dekarbonisierung voranzutreiben. Diese regulatorischen Maßnahmen schaffen ein günstiges Umfeld für Innovationen und Investitionen im ClimateTech-Bereich. Ein Beispiel dafür ist der deutsche Klima- und Transformation Fonds.

“Während Startups in vielen Märkten aktuell mit Kapitalknappheit zu kämpfen haben, schließen erfolgreiche GreenTech-Unternehmen weiterhin Millionen-Runden ab”, führt Vention’s Business Development Manager Joris Hecher dazu aus. Die kontinuierliche Innovation und die wachsende Investitionsbereitschaft machen die Region zu einem zentralen Akteur im globalen ClimateTech-Markt. Investitionen in Effizienztechnologien für Gebäude sind in Europa beispielsweise im Jahr 2023 um 73 % im Vergleich zu den Vorjahren gewachsen, was das Potenzial für weitere Expansion in diesem Bereich unterstreicht.

Zudem verlagern sich Investitionen zunehmend von Mobilität hin zu emissionsintensiveren Sektoren wie der Industrie, was auf langfristige wirtschaftliche Trends hinweist, die das Wachstum des ClimateTech-Marktes weiter vorantreiben werden.

Wichtige Treiber der ClimateTech-Innovation

In der Wirtschaft und den gesellschaftlichen Werten nimmt das Thema ClimateTech einen immer höheren Stellenwert ein. Verschiedene Veränderungen führen dazu, dass grüne Technologien heute gefördert werden und die Nachfrage nach ihnen wächst. Die wichtigsten treibenden Kräfte für ClimateTech sind:

Die Bedrohung der globalen Erwärmung

In den letzten Jahren haben sich die Gefahren, die durch CO₂-Emissionen entstehen, immer deutlicher gemacht. Strengere gesetzliche Vorschriften und globale Klimaziele, wie das Pariser Abkommen, fördern deshalb immer mehr die Entwicklung und Implementierung neuer Technologien, die zur Reduzierung von Treibhausgasemissionen beitragen.

Förderprogramme

Regierungen stellen erhebliche Mittel zur Verfügung, um die Forschung und Entwicklung im Bereich ClimateTech zu unterstützen. Dies schließt sowohl direkte Subventionen als auch steuerliche Anreize ein, die Unternehmen ermutigen, in umweltfreundliche Technologien zu investieren. Dies sind die wichtigsten Förderprogramme für ClimateTech in der DACH-Region:

-

Deutschland: KfW-Förderprogramme, Bundesförderung für effiziente Gebäude (BEG), Nationale Klimaschutzinitiative (NKI), Bundesprogramm Energieeffizienz in der Wirtschaft, BMWi-Förderprogramme für Wasserstofftechnologien.

-

Österreich: Klimafonds-Förderprogramme, Umweltförderung im Inland, Forschungsförderungsgesellschaft (FFG).

-

Schweiz: EnergieSchweiz, Technologie- und Innovationsförderung (Innosuisse), Förderprogramm Klimaschutz Schweiz.

Technologische Fortschritte

Fortschritte in Bereichen wie KI und ML, IoT und Big Data ermöglichen es Unternehmen, effizientere und effektivere Lösungen zu entwickeln. Diese Technologien helfen dabei, große Mengen an Daten zu analysieren und fundierte Entscheidungen zu treffen, die den Klimaschutz verbessern.

„Durch die gezielte Nutzung dieser Technologien können Unternehmen nicht nur ihren Energieverbrauch optimieren und Ressourcen effizienter einsetzen, sondern auch präventive Maßnahmen ergreifen, um Umweltschäden zu vermeiden“, erklärt Alex Skomyanov, technischer Berater von Vention. „Insgesamt tragen diese datenbasierten Entscheidungen dazu bei, die Nachhaltigkeit zu fördern und den ökologischen Fußabdruck erheblich zu reduzieren.“, schließt Skomyanov seine Einordnung ab.

Wachsendes Bewusstsein und Nachfrage der Verbraucher

Immer mehr Menschen und Unternehmen erkennen die Notwendigkeit, umweltfreundliche Praktiken zu unterstützen und tragen aktiv zur Reduzierung ihres ökologischen Fußabdrucks bei. Dieses gesteigerte Umweltbewusstsein treibt die Nachfrage nach ClimateTech- und GreenTech-Lösungen an und fördert die Entwicklung neuer und innovativer Technologien.

Internationale Zusammenarbeit und Wissensaustausch

Durch globale Netzwerke und Partnerschaften können Unternehmen und Forschungseinrichtungen ihr Wissen und ihre Ressourcen bündeln, um gemeinsam an Lösungen zu arbeiten, die den Klimawandel bekämpfen. Diese Kooperationen ermöglichen es, Innovationen schneller voranzutreiben und effektiver umzusetzen. “Gerade im Bereich von Risikokapital ist eine internationale Zusammenarbeit unerlässlich und es investieren vor allem US-amerikanische Kapitalgeber intensiv am europäischen Markt”, sagt Joris Hecher, Business Development Manager bei Vention.

Diese Faktoren treiben das Wachstum und die Entwicklung des ClimateTech-Sektors voran und schaffen neue Möglichkeiten und Herausforderungen für Unternehmen und Investoren gleichermaßen.

Namhafte CimateTech-Akteure in der DACH-Region

In einigen Sektoren haben sich bereits innovative, grüne Lösungen etabliert, die nicht nur ökologische Vorteile bieten, sondern auch wirtschaftliches Potenzial entfalten. Erfolgreiche Beispiele sind:

| Erneuerbare Energie |

|

| Energieeffizienz |

|

| Elektromobilität und Transport |

|

| Landwirtschaft und Lebensmitteltechnologie |

|

| Wasser- und Abfallmanagement |

|

| Kohlendioxid-Management |

|

| Grüne Finanzdienstleistungen |

|

| Anpassung an Klimakatastrophen |

|

Startup-Szene im Bereich ClimateTech

In den letzten Jahren hat sich ClimateTech zu einem der dynamischsten und am schnellsten wachsenden Segmente der Startup-Welt entwickelt, angetrieben durch steigende Investitionen, staatliche Förderprogramme und ein wachsendes Bewusstsein für den Klimawandel. Es fließt immer mehr Risikokapital in ClimateTech-Startups, insbesondere in Bereichen wie Elektromobilität, Energiespeicherung, Wasserstofftechnologien und CO₂-Abscheidung und -Speicherung (CCS).

Der Anteil der weltweiten VC-Finanzierung für ClimateTech hat sich in den letzten zehn Jahren mehr als verdreifacht. Obwohl die VC-Finanzierung für ClimateTech um ca. 30 % zurückging, stieg ihr Anteil an der VC-Finanzierung von 14 auf 16 %. Dies deutet darauf hin, dass ClimateTech-Startups zwar von der Marktkrise leicht betroffen sind, ihre Beliebtheit bei VCs aber zunimmt.

ClimateTech-Unicorns

In der Startup-Welt sind Unicorns Symbol für Erfolg und bahnbrechende Innovationen. Sie zeigen, dass es möglich ist, schnell zu skalieren und signifikante Marktanteile zu gewinnen, insbesondere in zukunftsträchtigen Bereichen wie ClimateTech.

Ein Unicorn ist ein privat geführtes Startup-Unternehmen, das eine Bewertung von über einer Milliarde US-Dollar erhält. Diese Unternehmen sind besonders relevant für die Wirtschaft, da sie oft als Indikatoren für bedeutende Innovations- und Wachstumspotenziale in spezifischen Technologiebereichen gelten. Enthusiastische Investitionen während des VC-Booms haben die Zahl der globalen Einhörner im Bereich der Klimatechnologie fast verdreifacht, so dass die aktuelle Zahl auf 97 aktive Unicorns stieg.

Ausgewählte Unicorns aus der DACH-Region:

-

1Climeworks (Schweiz): Entwickelt Technologien zur CO₂-Abscheidung aus der Luft, um CO₂-Emissionen zu reduzieren und zur Erreichung globaler Klimaziele beizutragen.

-

Sonnen (Deutschland): Bietet Speicherlösungen für Solarstrom und intelligente Energienetze, die Haushalte unabhängiger von fossilen Brennstoffen machen und die Energiewende fördern.

-

Tibber (Deutschland): Ein digitales Energieunternehmen, das durch intelligente Technologien den Energieverbrauch optimiert und den CO₂-Ausstoß reduziert.

-

1KOMMA5° (Deutschland): Installiert und vernetzt Solarenergie, Stromspeicherung und Wärmepumpen, um Haushalte nachhaltig und energieeffizient zu gestalten (BeBeez).

-

Sunfire (Deutschland): Entwickelt Elektrolyseure zur Produktion von grünem Wasserstoff und synthetischen Kraftstoffen, um industrielle CO₂-Emissionen zu senken.

Herausforderungen für ClimateTech-Startups

ClimateTech-Startups haben das Potenzial, bedeutende Beiträge zur Bekämpfung des Klimawandels zu leisten, stehen jedoch vor einer Reihe von finanziellen, regulatorischen und technischen Herausforderungen, die ihren Weg zur Marktreife und Skalierbarkeit erschweren:

Hoher Kapitalbedarf und lange Entwicklungszeiten

ClimateTech-Startups benötigen hohe Investitionen, da ihre Technologien oft auf langjähriger Forschung basieren. Diese Mittel sind meist schwer zu beschaffen und es dauert oft mehrere Jahre, bis ClimateTech-Innovationen marktreif sind und Gewinne erzielen können, was für Investoren ein erhöhtes Risiko darstellt.

Unsicherheiten im Markt

Investoren sind oft zurückhaltend, in ClimateTech-Startups zu investieren, insbesondere in wirtschaftlich unsicheren Zeiten. Dies liegt daran, dass viele dieser Technologien langfristige und teure Entwicklungsphasen haben, bevor sie marktreif sind.

Regulatorische Anforderungen können den Markteintritt erschweren und erfordern spezialisierte Kenntnisse, Anpassungen und zusätzliche Ressourcen. Neue EU-Richtlinien, wie die Corporate Sustainability Reporting Directive, fordern die Erstellung detaillierter Nachhaltigkeitsberichte und bedeuten größere Anforderungen an Transparenz und Dokumentation von Klimaschutzmaßnahmen.

Skalierbarkeit und Markteintritt

ClimateTech- bzw. GreenTech-Startups müssen zeigen, dass ihre Lösungen nicht nur nachhaltig, sondern auch wirtschaftlich tragfähig und skalierbar sind. Dies erfordert nicht nur technologische Innovationen, sondern auch effektive Geschäftsstrategien und starke Partnerschaften. Ohne Skalierbarkeit ist es schwierig, den breiten Markt zu erreichen und signifikante Umweltauswirkungen zu erzielen.

Zusammenarbeit und Integration

Eine erfolgreiche Umsetzung von ClimateTech-Lösungen erfordert oft die Zusammenarbeit mit etablierten Unternehmen und die Integration in bestehende Systeme. Dies kann komplex und zeitaufwändig sein, insbesondere wenn unterschiedliche technische Standards und Geschäftspraktiken berücksichtigt werden müssen. Die Integration neuer Technologien in bestehende Infrastrukturen erfordert oft umfangreiche Anpassungen und Koordination.

Trotz dieser Herausforderungen können ClimateTech-Startups mit der richtigen Unterstützung erfolgreich sein. Venture-Capital-Firmen und spezialisierte Inkubatoren können entscheidende Partner sein, um finanzielle Hürden zu überwinden. Durch die Kombination von Innovation, strategischen Partnerschaften und professioneller Beratung können Startups im Bereich GreenTech und ClimateTech ihre Ziele erreichen und einen bedeutenden Beitrag zum globalen Klimaschutz leisten.

Möchten Sie die Herausforderungen im ClimateTech-Bereich erfolgreich meistern?

Mit unserer strategischen Beratung können Sie Ihr Startup erfolgreich voranbringen.

Erfolgsfaktoren

Der Erfolg von ClimateTech-Unicorns hängt von einer Vielzahl von Faktoren ab, die es ihnen ermöglichen, schnell zu wachsen und bedeutende Marktanteile zu erobern. Dazu gehören unter anderem:

Innovation und Technologie

Technologische Innovationen sind der Motor für das schnelle Wachstum von ClimateTech-Unicorns. Alleinstellungsmerkmale (USPs) und kontinuierliche Forschung und Entwicklung (F&E) tragen zur schnellen Marktbewertung bei.

Diese Startups setzen sich durch effiziente und kostengünstige Batterien, CO₂-Abscheidetechnologien und erneuerbare Energielösungen von der Konkurrenz ab.

Marktnachfrage

Markttrends wie die Elektrifizierung des Verkehrs, der Ausbau erneuerbarer Energien und die Implementierung energieeffizienter Gebäude fördern das Wachstum von ClimateTech-Unicorns.

Investitionen und Finanzierung

Venture-Capital-Firmen, Business Angels und staatliche Förderprogramme tragen die notwendigen finanziellen Mittel bei. Diese finanzielle Unterstützung ermöglicht es den Startups, ihre Technologien weiterzuentwickeln, ihre Produktionskapazitäten zu erweitern und in neue Märkte zu expandieren.

Regulatorische Unterstützung

Gesetze und Vorschriften, die nachhaltige Technologien fördern, schaffen ein günstiges Umfeld für Innovationen. Beispiele sind Subventionen für erneuerbare Energien, steuerliche Anreize und gesetzliche Vorgaben zur Reduktion von CO₂-Emissionen.

Starke Führungsteams

Gründer und Führungskräfte mit fundierten Kenntnissen im Bereich Technologie und Wirtschaft können mit strategischen Entscheidungen Wachstum und Skalierbarkeit des Unternehmens fördern. Talentierte Mitarbeiter anzuziehen und zu halten, ist ebenfalls entscheidend für den langfristigen Erfolg.

Strategische Partnerschaften

Kooperationen mit anderen Unternehmen, Forschungseinrichtungen und Regierungen können den Marktzugang erleichtern und Synergien schaffen. Dies ermöglicht es ClimateTech-Unicorns, Ressourcen zu teilen, technologische Innovationen zu beschleunigen und ihre Marktpräsenz zu erweitern, was in dem dynamischen und interdisziplinären Bereich von ClimateTech besonders wichtig ist.

“Eine große Herausforderung vieler Akteure ist die erfolgreiche Integration von Hardware und Software”, ergänzt Vention’s Business Development Manager Joris Hecher. „Während Europa im Allgemeinen und der DACH-Raum im Besonderen international weiterhin für seine Ingenieurskunst bekannt sind, zählt die Softwareentwicklung oft nicht zu den Kernkompetenzen der Unternehmen. Statt sich mit durchschnittlicher Qualität zufrieden zu geben, wenden sich daher immer mehr Unternehmen an externe Softwareentwicklungspartner, um maßgeschneiderte Software anbieten zu können“, erklärt Hecher weiter.

Öffentliche Wahrnehmung und die Einführung von ClimateTech

Die öffentliche Wahrnehmung spielt eine entscheidende Rolle bei der Einführung und Akzeptanz von ClimateTech-Technologien. Positive Wahrnehmung und Unterstützung durch die Gesellschaft können die Implementierung solcher Technologien erheblich beschleunigen, während Skepsis und mangelndes Vertrauen diese behindern können.

Faktoren, die die öffentliche Wahrnehmung beeinflussen:

-

Bildung und Aufklärung: Die Kenntnis über die Vorteile und Funktionsweisen von ClimateTech ist essenziell, um die Akzeptanz in der Bevölkerung zu erhöhen. Initiativen zur Aufklärung über erneuerbare Energien, Energieeffizienz und andere umweltfreundliche Technologien tragen dazu bei, das Bewusstsein und Verständnis zu fördern.

-

Medienberichterstattung: Die Art und Weise, wie ClimateTech in den Medien dargestellt wird, beeinflusst die öffentliche Meinung stark. Positive Berichte über Erfolge und Innovationen im ClimateTech-Sektor können das Vertrauen stärken und die Akzeptanz erhöhen. Negative Berichterstattung über Fehlschläge oder Umweltauswirkungen kann hingegen Skepsis schüren.

-

Politische Unterstützung: Regierungen spielen eine Schlüsselrolle bei der Gestaltung der öffentlichen Wahrnehmung. Durch die Einführung und Förderung von politischen Maßnahmen, die nachhaltige Technologien unterstützen, können sie das Vertrauen der Bevölkerung gewinnen und die Akzeptanz neuer Technologien fördern.

-

Transparenz und Vertrauen: Unternehmen, die im Bereich ClimateTech tätig sind, müssen transparent über ihre Prozesse, Ziele und Ergebnisse kommunizieren. Transparenz schafft Vertrauen und kann Bedenken hinsichtlich der Umweltauswirkungen und der Zuverlässigkeit neuer Technologien mindern.

Durch die Kombination von Aufklärung, transparenter Kommunikation, politischer Unterstützung und finanziellen Anreizen können die Herausforderungen bei der Einführung von ClimateTech überwunden werden. Eine positive öffentliche Wahrnehmung ist entscheidend, um den Übergang zu einer nachhaltigen Zukunft zu beschleunigen.

Zukünftige Aussichten: Was bis 2030 zu erwarten ist

Bis 2030 wird erwartet, dass grüne Technologien und nachhaltige Initiativen weltweit erheblich vorangetrieben werden. Die Europäische Union hat beispielsweise ehrgeizige Pläne zur Förderung erneuerbarer Energien und zur Reduktion von CO₂-Emissionen angesetzt.

Maßnahmen wie der Europäische Grüne Deal zielen darauf ab, die Wirtschaft der EU bis 2050 klimaneutral zu machen. Wichtige Vorgaben des EU Green Deals:

-

Reduktion der Treibhausgasemissionen: Die EU hat sich verpflichtet, die Treibhausgasemissionen bis 2030 um mindestens 55 % im Vergleich zu 1990 zu reduzieren.

-

Erhöhung des Anteils erneuerbarer Energien: Bis 2030 soll der Anteil erneuerbarer Energien auf mindestens 42,5 % erhöht werden, mit einer angestrebten Steigerung auf 45 %. Dies beinhaltet erhebliche Investitionen in Solar- und Windenergie sowie in andere erneuerbare Energiequellen.

-

Verbesserung der Energieeffizienz: Die EU hat als Ziel eine Verbesserung der Energieeffizienz um 11,7 % bis 2030 festgelegt. Mitgliedstaaten müssen jährliche Einsparungen von durchschnittlich 1,49 % von 2024 bis 2030 erreichen.

-

Renovierung von Gebäuden: Der Renovierungswelle-Plan zielt darauf ab, die Energieeffizienz von Gebäuden zu verbessern, insbesondere durch die Dekarbonisierung von Heizung und Kühlung sowie die Renovierung öffentlicher Gebäude wie Schulen und Krankenhäuser.

-

Nachhaltige Mobilität: Bis 2030 sollen mindestens 30 Millionen emissionsfreie Autos auf europäischen Straßen sein, 100 Städte sollen klimaneutral werden und der Hochgeschwindigkeitszugverkehr soll sich verdoppeln. Zudem sollen Maßnahmen zur Förderung von emissionsarmen Verkehrsmitteln und zur Reduktion der Emissionen aus dem Verkehr umgesetzt werden.

-

Kohlenstoffpreisgestaltung: Die EU plant, den Emissionshandel auf den Straßenverkehr auszuweiten und die Kohlenstoffpreisgestaltung auf die Schifffahrt und den Flugverkehr anzuwenden. Dies soll Anreize für sauberere Kraftstoffe schaffen und Investitionen in saubere Technologien fördern.

Diese umfassenden Maßnahmen sind Teil des Bestrebens der EU, die führende Rolle bei der globalen grünen Transformation zu übernehmen und nachhaltige Entwicklungen voranzutreiben.

Die Aussichten für die Entwicklung von ClimateTech bis 2030 sind also vielversprechend, mit erheblichen Investitionen und politischer Unterstützung, die darauf abzielen, technologische Innovationen voranzutreiben und eine nachhaltige Wirtschaft zu fördern.

Fazit

ClimateTech, GreenTech und CleanTech bieten Lösungen zur Reduktion von CO₂-Emissionen, Verbesserung der Energieeffizienz und Förderung erneuerbarer Energien. ClimateTech-Startups sind Vorreiter dieser Transformation und tragen durch innovative Hardware und maßgeschneiderte Softwarelösungen entscheidend zum Klimaschutz bei.

Die kommenden Jahre bis 2030 versprechen bedeutende Fortschritte, unterstützt durch politische Maßnahmen und erhebliche Investitionen in grüne Technologien. Die Entwicklung von ClimateTech-Ökosystemen, die Startups, etablierte Unternehmen, Investoren, Regierungen und Forschungseinrichtungen einbeziehen, schafft neue Wertschöpfungsketten, die zur Förderung der Skalierung nachhaltiger Technologien und zur verbesserten Marktintegration neuer Technologien beitragen können. Die Zusammenarbeit aller Akteure ist entscheidend, um die Potenziale von grünen Technologien und Lösungen voll auszuschöpfen, Klimaziele zu erreichen und eine nachhaltige Zukunft zu gestalten.

Ihr Unternehmen möchte auf dem neuesten Stand der ClimateTech-Innovation sein?

Wir unterstützen Sie mit maßgeschneiderten Softwarelösungen und fundierter Beratung, um die nötigen technologischen Fortschritte umzusetzen und Ihre Klimaziele zu erreichen.