How femtech startups transform women's healthcare

Given that 50 percent of the world’s population are women, you’d think that technology for women (“femtech”) would have gotten a lot more traction than it has — but that’s changing fast. Between 2011 and 2022, only about three percent of US digital health deals focused on women’s health, and the global femtech market size accounted for a modest $47 billion in 2022. As for the future? Estimates suggest that the femtech market size will reach $103 billion to $1 trillion (yes, you read that right) by 2027.

Baffled by the difference in the projections? Don’t be. No matter what figure you go with, the same thing is crystal clear: VCs are watching femtech, finally recognizing it as a viable, non-fringe investment.

Gird your loins.

What is femtech

Hang onto your socks for this reality check: Until 1993, women in the US were excluded from participating in clinical research and trials due to the belief that their hormone cycles would distort test results. For decades, talking about women's sexual and reproductive health was considered taboo; even now, leading media like Meta and Instagram reject women's health ads because of allegedly “inappropriate” content.

It should come as no surprise then that the femtech industry was conceived as recently as 2016. The term “femtech” was coined by Ida Tin, the Danish-born founder of Clue, a period tracking app currently used by 8 million women in 180 countries.

Tin was one of the first to promote the idea that there are at least 4 billion reasons femtech is an autonomous business space. Not only do women make up half the planet, but they account for roughly $35 trillion in annual global consumer spending, which represents enormous opportunity.

Opportunity, however, isn’t just rooted in what’s in women’s wallets; it’s also rooted in their health concerns and conditions, which are often very distinct from those of men. The latter statement rests on a few surprising (for some) truths.

- Men and women suffer from many of the same diseases, but the symptoms can manifest differently. (For example, women can experience a heart attack without feeling chest pain or pressure.)

- Our biological sex determines susceptibility to some diseases and conditions. Autoimmune diseases, for example, strike women far more frequently than they do men, and women are more susceptible to stress cardiomyopathy.

- On average, women live longer than men, which makes them a higher risk for Alzheimer’s and other dementias. (In fact, almost two-thirds of Americans with Alzheimer’s dementia are women.) And this disparity isn't solely attributable to longevity: Studies suggest that biological differences, such as the decline in protective estrogen levels post-menopause, may contribute to increased dementia vulnerability in women.

- Ethnic and socioeconomic factors lead to the differential distribution of health risks and disparity in treatment among women. Black women, for example, face significant health disparities, like shorter life expectancies and a disproportionate burden of chronic conditions compared with other US women.

So, what is femtech exactly? “Femtech” acknowledges fundamental aspects of women’s health and appropriately delineates the tech-enabled solutions that address female-specific conditions and needs, including fertility, pregnancy, childcare, menstruation, menopause, pelvic and sexual health, contraception, family health, and other general conditions that affect women’s health and well-being.

That’s where femtech solutions like mobile health apps, telehealth products, wearables, and connected devices designed exclusively for women come into play.

The current state of the femtech market

Femtech companies may still account for only a tiny fraction of all digital health players (just six percent of overall digital health funding in 2022), but there has been a 1,000 percent increase in the number of businesses in the space over the last 10 years — meaning that this niche is blossoming into a force to be reckoned with.

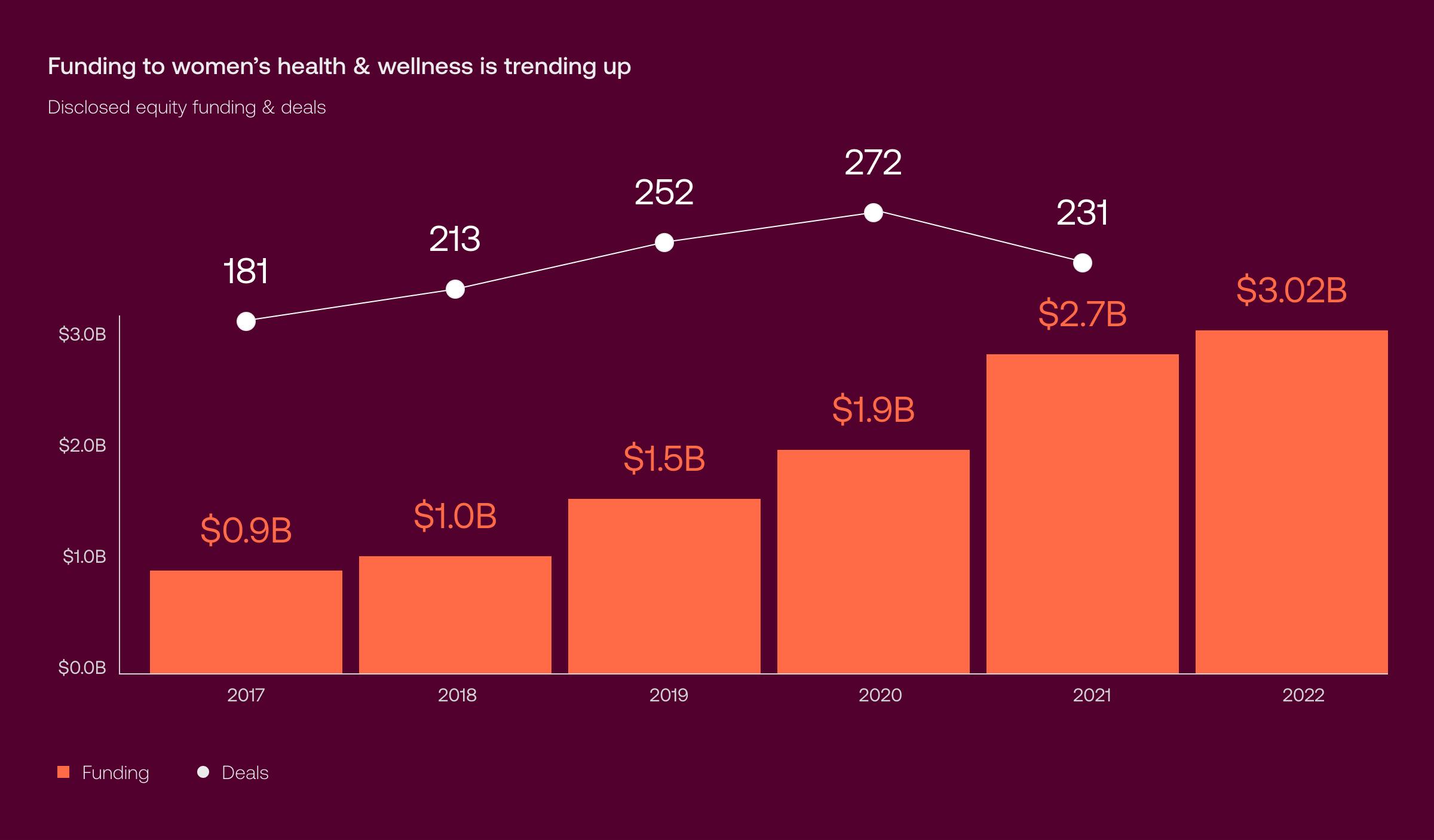

Plus, despite economic headwinds in the 2021/2022 period, investment in the global femtech market has increased markedly. CB Insights data shows that in 2021, this reached a record $2.7B in funding — up 44 percent from $1.9B in 2020. Furthermore, 2022 saw this momentum continue, with funding totaling $3.02B, as reported by Fortune Business Insights.

The sector also shows early signs of maturity: Even though the number of deals dropped from 272 in 2020 to 231 in 2021, the average deal size is increasing. Larger investment rounds and megarounds — deals worth $100 million or more — are no longer the rarity they once were, meaning we can expect more femtech companies and women's health startups to become unicorns and go public.

The largest femtech deal of 2022 was BillionToOne's $125M round Series C; this molecular diagnostics company helps physicians screen unborn babies for rare genetic conditions. In 2023 (so far), the most notable funding achievement belongs to fertility clinic Kindbody, which secured an impressive $100M.

But despite these signals that femtech is gaining traction, the fact remains that venture capital remains male-dominated, and investors with XY chromosomes tend to overlook business opportunities that solely affect those with XX chromosomes. (It’s no accident that fertility startups have always garnered the largest funding — about 37 percent — in the femtech industry: Fertility challenges affect men, too.)

Looking to build a profitable femtech solution that makes a difference?

Our software experts are ready to discuss your project requirements and start right away.

Types of woman's health startups and top femtech companies

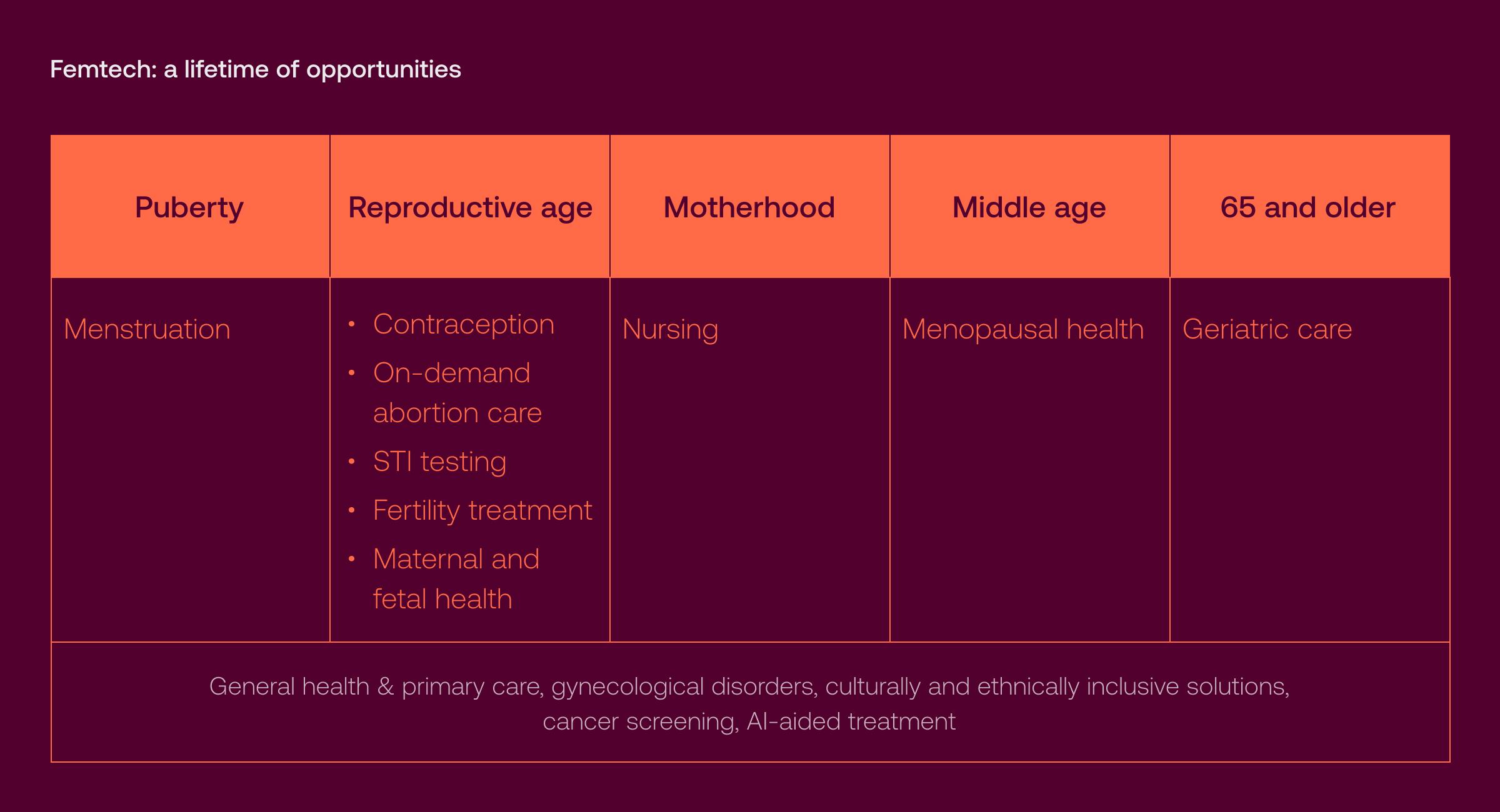

While fertility care is indeed one of the most important sub-sectors of femtech, the opportunity for women’s healthcare innovation extends far beyond the market of women in their reproductive years: There are roughly 1 billion women past childbearing age in the world and 600 million girls in puberty.

A growing crop of women's health startups are working hard to help consumers and femtech investors recognize that women are not born as adults like Aphrodite and that there are still 40+ years of a woman's life once the child-bearing years are over. Innovative, effective, and safe femtech apps that support women from menarche to menopause and beyond are the latest frontier.

Below is a non-exhaustive list of how businesses transform how women prevent, detect, and manage their health conditions throughout their lives.

Puberty

According to a survey conducted by the global consulting firm Kearney, 37 percent of girls in the United States have no or very limited knowledge about menstruation before their first period. Recognizing the problem, a significant portion of femtech businesses work to improve menstrual health and hygiene management for teens and young women.

Reproductive age

For women from puberty through menopause, femtech products serve a host of sexual and reproductive health needs:

Contraception: Companies in this category offer contraceptive plans based on a woman's unique medical needs. For instance, telehealth startup Nurx (which merged with Vention client Thirty Madison in late 2022) provides online consultations for women to easily access their regular birth control as well as emergency contraception.

For those who favor making informed decisions independently, startups like Tuune offer at-home finger-prick tests to assess women’s hormone levels and recommend the best birth control.

On-demand abortion care: The recent overturn of Roe v. Wade has increased the demand for medication abortions. Companies like Hey Jane are essentially digital clinics that provide patients with safe, FDA-approved abortion pills. Hey Jane has strategically chosen to operate in California, Colorado, Connecticut, Illinois, Maryland, New Jersey, New Mexico, New York, and Washington — states that border territories with more restrictive abortion laws like Texas, Louisiana, Missouri, and South Dakota.

STI testing: Another segment getting traction is at-home diagnostics of sexually transmitted infections (STIs). A great example is Evvy, a women's health startup that offers easy-to-use STI screening kits and teleconsultations based on the results.

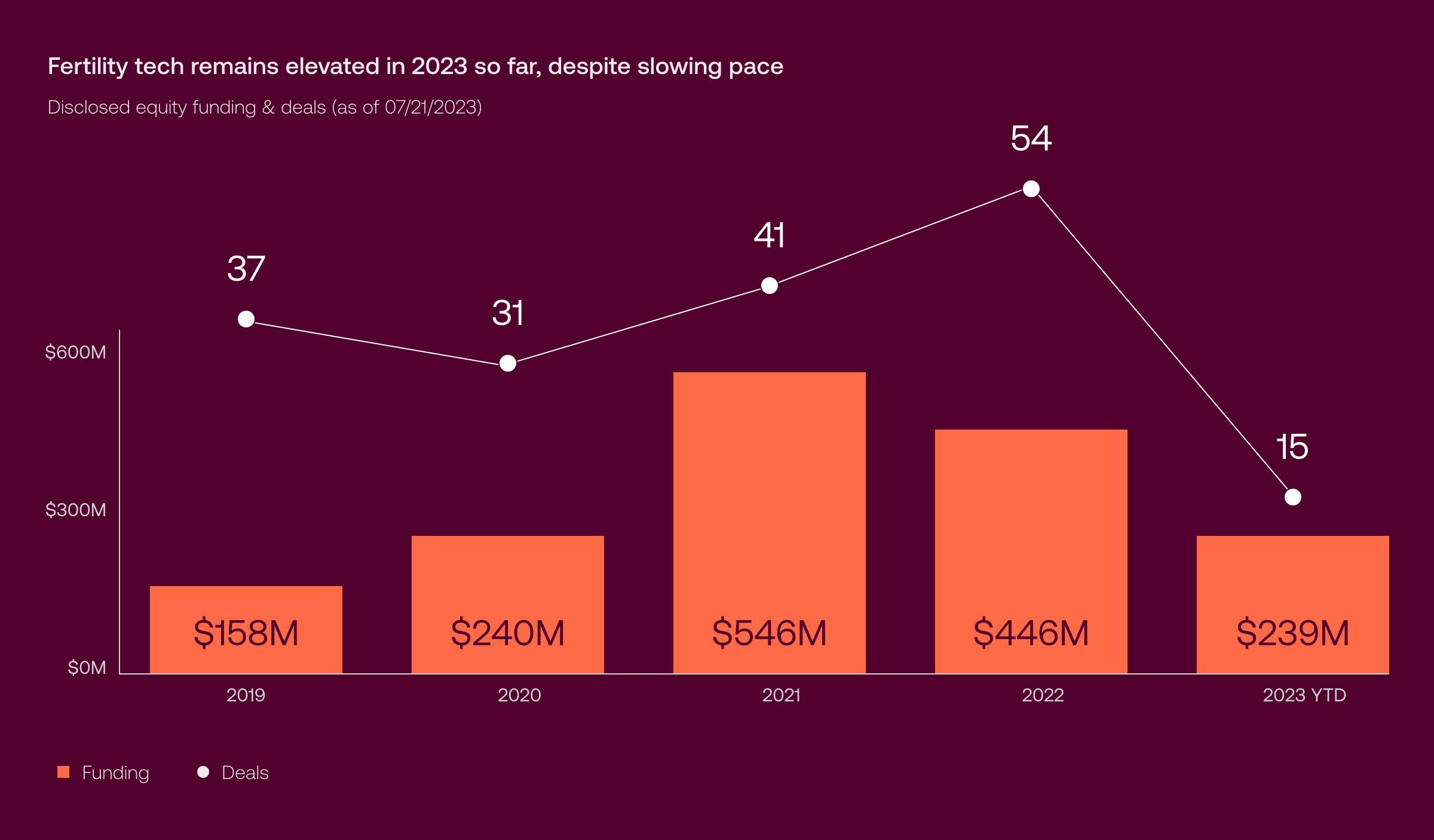

Fertility treatment: Fertility tech companies have raised $1.5B in equity funding since 2019 — more than any other femtech sub-industry. Even though there was a dip in funding in 2023 owing to a wider economic slump, the demand for fertility services ensures that the funding level remains high.

With IVF often carrying a hefty price tag (a single round of IVF treatment typically costs more than $15K), a range of startups are looking for creative ways to curb these expenses. Take a look at Gaia, an IVF-focused insurance company that uses a proprietary prediction tool to help families understand their odds of IVF success and, hence, avoid draining investments in unsuccessful procedures. (And yes, members who don’t conceive owe nothing.)

Maternal and fetal health: These femtech startups are mainly focused on pregnancy. Consider Washington-based company Babyscripts, which offers a remote monitoring platform providing healthcare providers with tools and crucial data to assess and manage pregnancy risks. Then there’s Oula Health, a “modern maternity center” offering remote and in-person obstetrics and midwifery care.

Motherhood

Femtech apps and solutions in this category assist new moms with the knowledge, skills, and confidence for a better transition to a new role.

Other businesses build hardware and wearable baby care and monitoring solutions. NY-based Nanit, for example, develops computer vision-enabled smart cameras to track everything happening in and around the crib in real time.

Middle age

These startups address challenges around menopause and other mid-life health conditions. As ovaries age more than twice as fast as all other tissues, there are quite a few solutions that prolong ovarian function to ultimately extend women’s lifespans, including Oviva Therapeutics and Gameto, a biotech that aims to delay ovarian decline — and eventually push it off forever — through cellular reprogramming.

Go-getters in this space are definitely onto something: Some estimates put the menopausal market at $600B. And given that women over 45 represent 45 percent of working women in the US — with most of them experiencing menopausal symptoms that impact work performance and satisfaction — it’s safe to say we'll observe an uptick in companies dedicated to alleviating menopause-related challenges.

65 and older

Globally, the population aged 65 and over is growing faster than any other age group; that’s why we’re beginning to see a greater range of women’s health companies catering to an older demographic. These pioneers primarily deal with feminine incontinence products (Joylux, which offers home-use LED devices to address pelvic floor issues like urinary incontinence and vaginal dryness) and solutions that evaluate risks of age-related conditions like osteoporosis (Stella by Vira Health).

General health and primary care across age groups

These femtech companies address general health conditions that may show up with different symptoms, severity, and prevalence in women. One of the top femtech startups working in this space is our client Aavia, which we partnered with for project management and iOS app development services. Aavia offers a patented birth control pill case and a mobile app that helps users gain better insight into their hormonal cycles and, ultimately, optimize their physical and mental health.

“Historically, medical research has been predominantly conducted on and by people with testes, which means that hormone fluctuations and potential pregnancies weren’t considered in the development of health services, many times intentionally,” says Aya Suzuki, co-founder of Aavia.

That gap in health data, Suzuki adds, puts women at risk because they’re still prescribed the same medications and therapies as men without taking into account biological differences like hormone cycles.

“Hormonal fluctuations are normal and part of being a female,” she says. “It’s imperative that these differences are acknowledged and understood, and thankfully now more work is being done to care for female bodies.”

Gynecological disorders: Femtech startups in this space tackle the most common chronic gynecological diseases like polycystic ovary syndrome (PCOS) and endometriosis, affecting roughly 13 and 10 percent of women, respectively. Prominent examples include California-based healthtech NextGen Jane, which is developing smart tampons that detect early signs of endometriosis, and Allara Health, which just raised a $10M Series A to expand its telehealth platform for women with chronic hormonal conditions.

Other women's health startups are entering the scene to democratize and normalize women's sexual health services. For instance, the Rosy app creates stigma-free sexual wellness plans for women struggling with low libido.

Culturally and ethnically sensitive products: These are femtech apps tailored to the health needs of women in underrepresented populations: LGBTQIA+ folks (FOLX Health, specializing in queer healthcare, and Plume, a gender-affirming hormone therapy company that has raised $44M to date); low-income communities (Kasha, which provides health and self-care products for rural communities in Africa); BIWOC-focused initiatives adressing mental health, guided visualizations, and coaching designed by and for multiracial populations.

Additionally, substantial evidence suggests menopause can be more intense for women of color compared to white women. Femtech startups like Alloy recognize that Black women experience distinct physical, psychological, and social differences during menopause and tailor their services to address them.

Cancer screening: As oncologic conditions are a leading cause of death worldwide, the femtech market map wouldn’t be complete without startups building accessible screening products for ovarian, breast, and cervical cancers. For example, Olea Medical develops apps that provide automatic data visualization for women’s health MRIs.

And don’t forget to check out AOA Dx, a biotech developing liquid biopsy diagnostic tests that are reportedly 53 percent more effective at detecting early-stage ovarian cancer than existing tests. This femtech company has just raised $17M to open new lab facilities and expand their ovarian cancer prospective clinical trials.

How femtech companies are using AI to elevate women’s health

The adoption of AI in femtech is to some degree a reflection of the healthcare sector's broader embrace of conversational AI, predictive modeling, and machine learning. As healthcare industries pivot toward more personalized and preventive care, AI's capability to analyze vast datasets offers unprecedented insights that enhance diagnostics, treatment, and patient engagement.

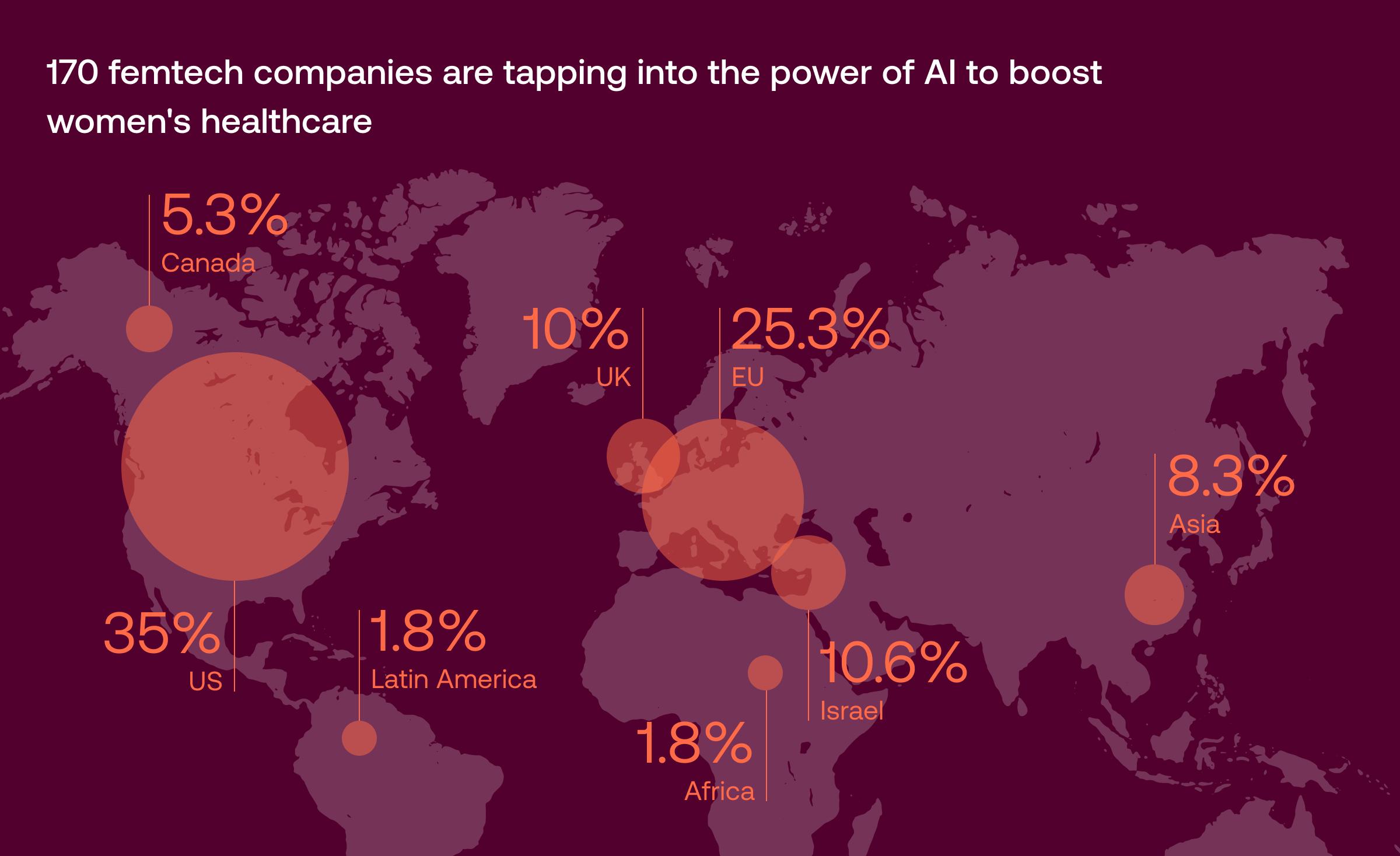

Over 170 femtech startups are currently utilizing AI technologies to carve out a space where women wield more voice, knowledge, and control. On the global map, the US leads the pack, boasting 35 percent of the AI-driven companies, while the EU secures a solid second with 25.3 percent.

Examples of femtech startups implementing AI include:

- Fertility tracking and prediction tools (Natural Cycles, Mira)

- AI-powered menstrual cycle tracking and prediction apps (Maya)

- Breast and cervical cancer detection using AI algorithms (MobileODT, Koios)

- Personalized birth control and abortion care (carafem, The Lowdown)

- Tailored nutrition and training plans based on user data (Wild.ai)

- AI-based telemedicine platforms (Tia, Marani Health)

- AI-assisted radiology for gynecology and obstetrics (Kheiron)

- AI-enhanced wearables for health data monitoring (Ava)

- Mental health support and therapy services (Peanut)

- Predictive algorithms for forecasting and averting pregnancy issues (Sonio)

- Custom IVF protocols and selecting the most viable embryo for transfer (Univfy, Fairtility)

In the age of AI, where progress and privacy often clash, it's never been more vital to guard femtech data — especially in the wake of the overturn of Roe v. Wade. As we champion technological progress, we should remember that pushing technological boundaries should not compromise women’s safety in any context. Striking the right balance involves stringent data protection measures, minimal personal data usage, and consistent anonymization.

Is femtech the next big thing in healthcare?

As more and more women run businesses and investment funds, women’s healthcare will logically become an increasing priority. Similarly, as 70 percent of femtech startups have at least one woman founder, the scales will continue to tip toward funding companies that support women. Add in the fact that current early-stage femtech startups are maturing past small-fry status to garner late-stage capital investments (like Delphinus), and more and more funding will be directed toward femtech as time goes on.

Moreover, in just a few years, a new generation of women that has grown up amid a newer wave of women’s and trans rights and equality movements will gain more influence, which should result in more solutions that move beyond stereotypes and stigmas attached to female health and sexuality. We can expect to see more products and services for menopause symptom management, specialized care for queer and transgender communities, sex education for young women, and interventions to address high maternal mortality — especially among women of color.

Plus, as women globally assert more control over their bodies, we anticipate a rise in cultured breast milk offerings (not all women want to or can breastfeed) and a lean towards non-hormonal contraceptive alternatives like femtech Phexxi.

We could also see a rise in the demand for solutions supporting women’s health in the workplace, as more employers see this as a necessity to retain women. As they strive to do their part in protecting women’s reproductive rights in a post-Roe world, many companies will also provide more health plans that cover abortions and travel expenses if needed.

Consider as well that blockchain — a startup darling and investment magnet — is wending its way into reproductive health, just as it has with just about every other industry. Femtech companies like Elevance Health and Eggschain allow people to store records of frozen eggs, embryos, and other biospecimens in a decentralized and immutable infrastructure. These products could also produce more use cases that demonstrate how women can securely manage their identity and maternal and reproductive health data — a major concern since the overturn of Roe v. Wade — using crypto technologies.

The femtech market is moving towards having a more defined value in the consumer market and generating active interest from investors, payers, and healthcare providers. And while it might seem just a small step for the digital health space in general, that’s a giant leap toward finally making “fem” and “tech” equals.