The path to joining the club: How long it takes to become a unicorn

Growth at all costs and hostile market expansion used to be the foremost strategy of most unicorn wannabes. Well, not anymore.

Shrinking valuations at tech companies and the scarcity of capital are making it tougher for up-and-coming players to catch up with the existing unicorn herd. Many startups have come to a striking realization: The “earn it, then burn it” mindset is not sustainable.

Not only that, but long-term profitability is making a comeback as the metric that matters most. An increasing number of companies that previously planned to secure later-stage funding this year are now prioritizing generating returns for their investors and stakeholders.

Andrew Haines, our Global Head of Fintech, thinks that the investing environment has become more methodical. “Unicorns in 2014-2017 were all about eyeballs. It didn’t matter if they were making money or not,” he says. “Now investors are looking at companies and saying: ‘You have a viable product; now we need to make it profitable.‘“

But if unstable macro conditions (inflation, rising interest rates, and geopolitical crises) and a tightening VC market didn’t scare you away from raising Series C+ funding, and you still want to add a zero or two to your company’s valuation, then good news: Aiming for unicorn status in 2023 may not be as desperate as you think.

Unicorns aren’t going extinct

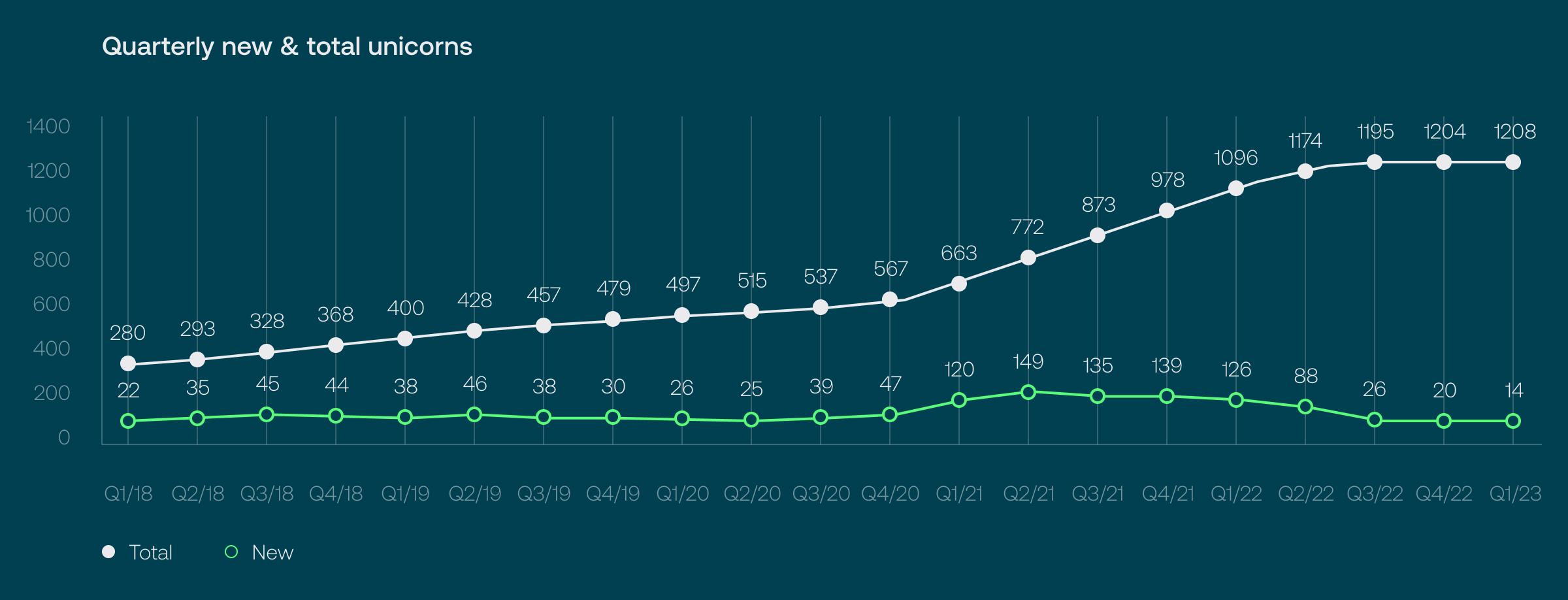

For context, back in 2013, only 39 startups were worth a billion dollars or more. Fast forward to today, and the number of unicorns has skyrocketed to 1,214 globally (as of May 2023), with a total combined valuation of approximately ~$3,862 billion.

2021 was a year of the billion-dollar baby boom; 539 businesses joined the unicorn club, which equals more than two per business day. In 2022, the tremors in the financial sector resulted in a 52 percent drop in the number of emerging unicorn companies YoY, while also exposing multiple existing unicorns to the risk of losing their horn. Q4’22 saw only 20 new unicorn births — down to about three every two weeks.

But is the drop actually a bad thing? Andrew doesn’t think so. “The current economic outlook is causing a pause in capital deployment,” he says. “Since the free money has come out of the market as a reflection of the downturn, a natural adjustment of expectations will happen.”

As many have pointed out before, what’s going on now is perhaps more of a correction than it is a recession. Unicorns are still being minted every month, but investors finally realized how unreasonably they were pricing late-stage value creation. As a result, the 2008 scenario may soon repeat: Startup valuations were significantly lower, which provided VCs with better investment terms to back companies with transformative potential.

In other words, the next generation of Slacks and Ubers is on the horizon, but, as Pitchbook’s unicorn tracker makes clear, AI, fintech, and climate tech are leading the charge.

Average time-to-unicorn is six years

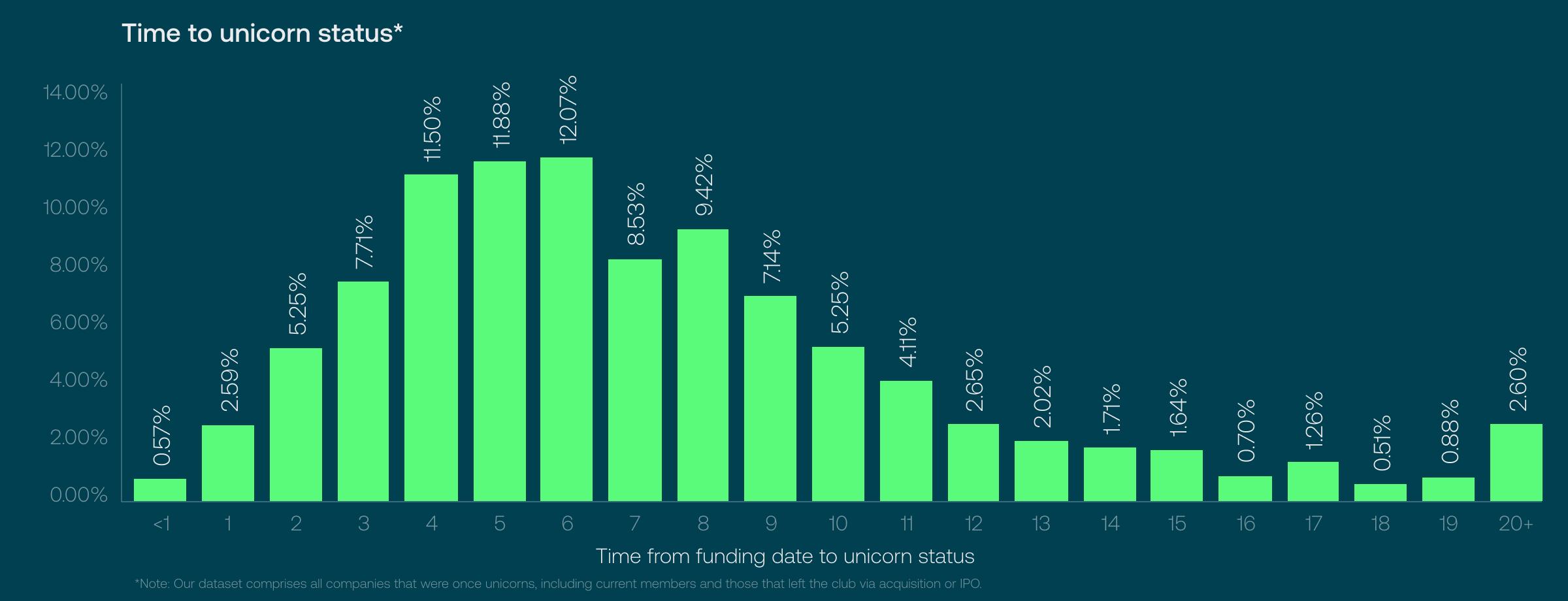

If you’re wondering how long it will take to reach a ten-figure valuation, brace yourself: Most companies take around six years to reach a 10-figure valuation, according to CB Insights data.

This timeline aligns with the typical fundraising stages for startups: 12 to 18 months for pre-seed, six to 12 months for seed, six to 18 months for Series A, 18 to 24 months for Series B, and up to 36 months for Series C.

Surprisingly, despite market instability, the average time-to-unicorn has remained relatively consistent. The reason is simple: Chasing shiny objects is the very essence of VC, and since many potential unicorns are focused on disruptive technologies, they often receive significant investment and attention from investors, regardless of the economic climate.

Case in point: the graph above shows that nine of the companies listed achieved a billion-dollar valuation in less than one year. No surprise here: Three of those are Usain Bolts of the startup world (Autograph, Phantom, and Mysten Labs) that build NFT-based and Web3 products — a major tech hype in 2020-2022.

Top 10 fastest unicorns*

|

Company |

Months from the |

Founded |

Date of becoming |

|

5 |

10/27/2015 |

12/4/2016 |

|

|

5 |

1/10/2020 |

3/24/2021 |

|

|

7 |

1/5/2021 |

12/28/2021 |

|

|

7 |

1/6/2014 |

1/16/2015 |

|

|

8 |

1/1/2020 |

9/21/2020 |

|

|

9 |

1/3/2021 |

2/12/2021 |

|

|

9 |

4/1/2021 |

1/20/2022 |

|

|

10 |

1/1/2021 |

11/16/2021 |

|

|

10 |

1/3/2021 |

1/31/2022 |

|

|

12 |

1/9/2021 |

8/9/2022 |

*This list includes only current unicorns.

AI and fintech mint unicorns at the fastest rate

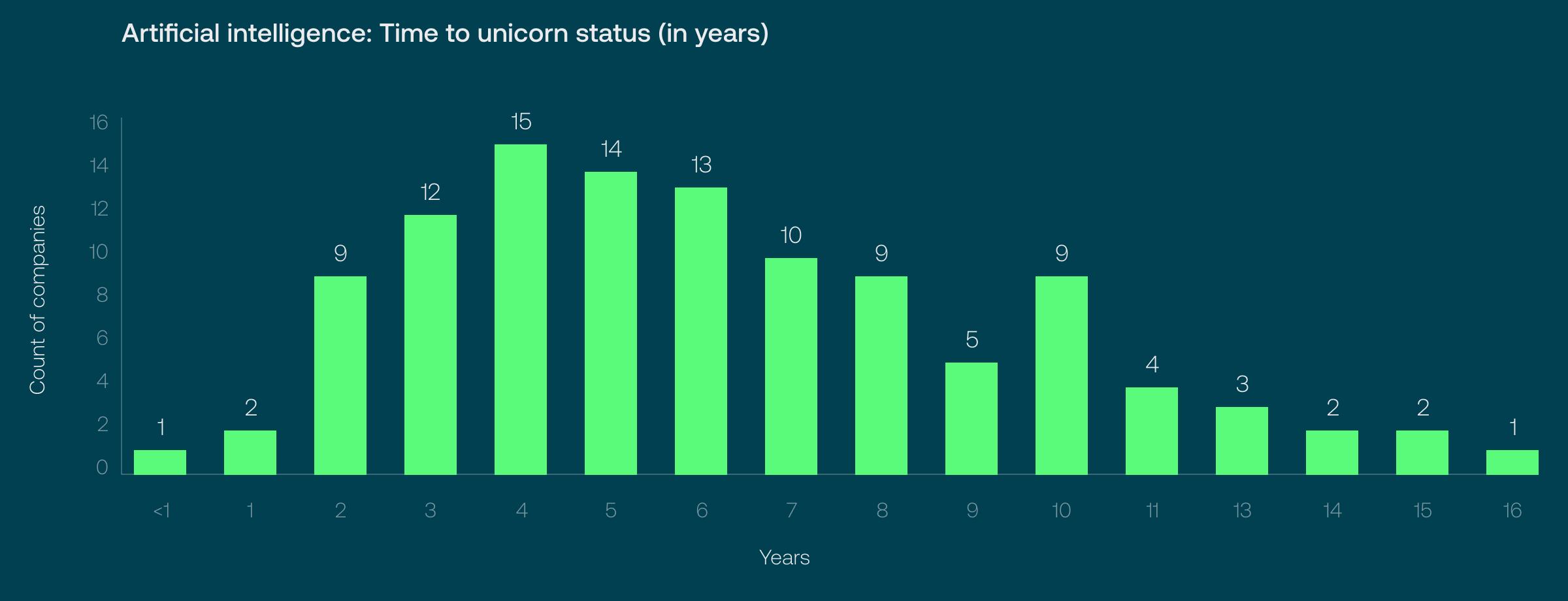

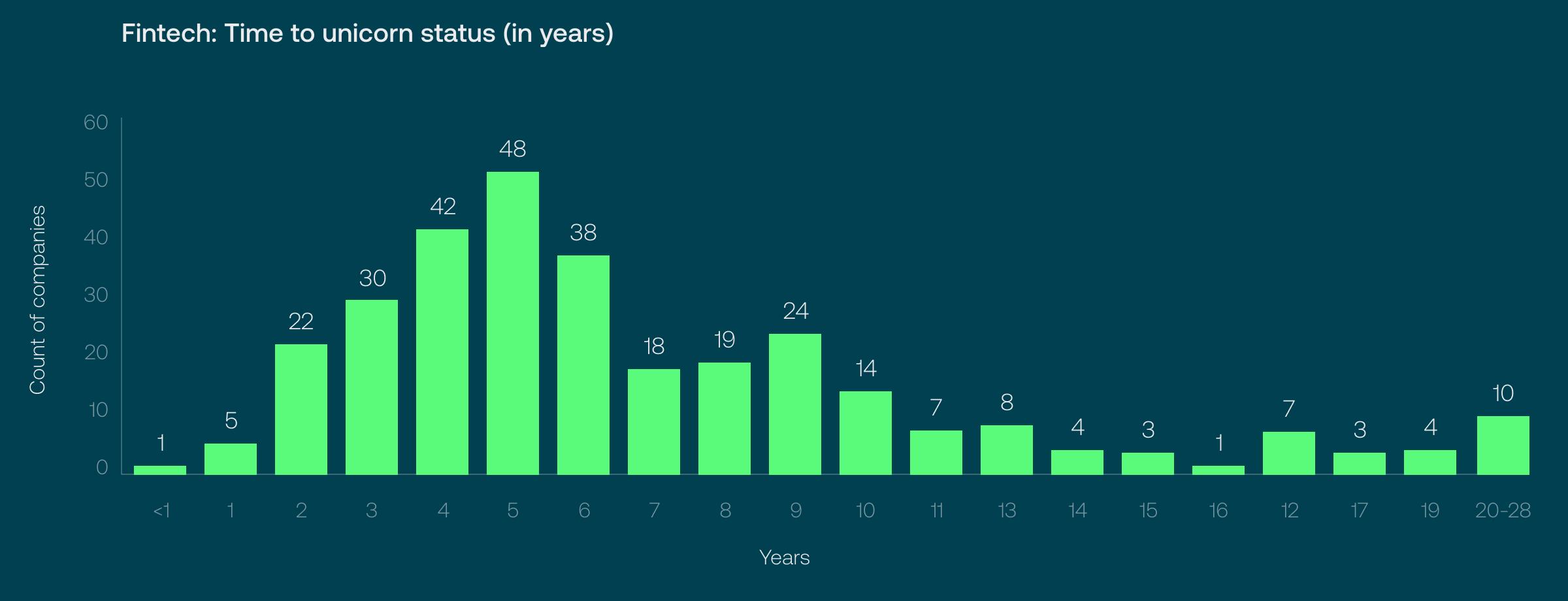

Our analysis of unicorn speed by industry revealed that out of all business domains, AI and fintech had a faster unicorn birth rate. For most unicorn companies powered by chatbots and ML models, it took just four years to hit a billion-dollar valuation, while for fintech startups, it took five.

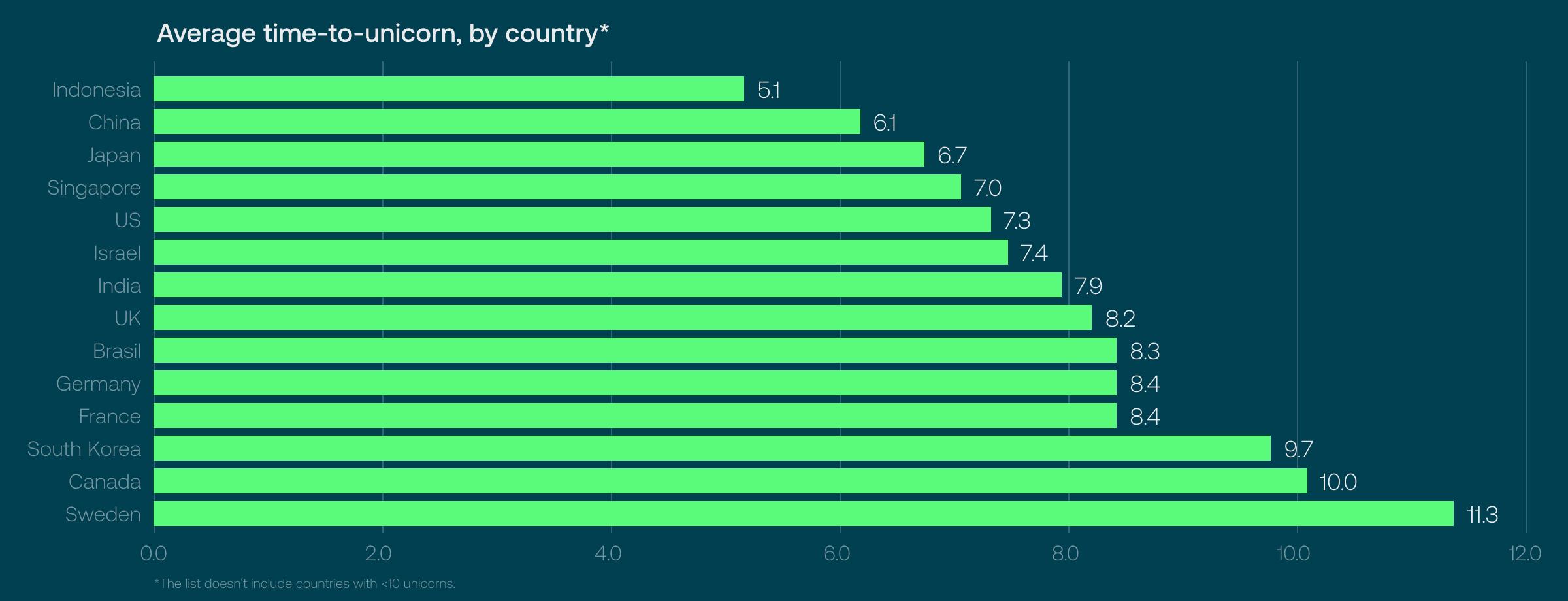

Countries that mint unicorns the fastest

Think you know what country boasts the fastest unicorns? That's unlikely, unless Indonesia is on your radar screen. Our analysis shows that Indonesian startups reach unicorn status in just 5.1 years on average, followed by those in China (6.1 years) and Japan (6.7 years). The US, despite being home to the highest number of unicorns globally, ranks fifth on the list of the fastest unicorns by country.

Why Indonesia? One theory is that the pandemic actually helped the country’s tech industry by accelerating digitization, which paved the way to surges in investment.

Focus on product-market fit

No matter your location, the path to becoming a unicorn company is never a straightforward process with a set timeline. It’s a very unpredictable journey with a ton of moving parts, such as the industry in which the company operates, the availability of funding, the strength of your leadership team, and most importantly, the actual viability of your product or service.

“Venture capital and private equity funds want to make sure their dollars go into solid investments,” Andrew says. “This, however, doesn't mean that new investments won’t happen — it means that they are becoming more asset-focused.”

New, innovative projects will still get funded, and proven business lines will get investment, but business leaders will be more actively managing their capital positions.

And to state the obvious: Startup success is not just about crossing the one-billion-dollar line quickly, but about holding onto the record, as WeWork sadly demonstrated. As there’s only a 0.00006 percent chance of building a billion-dollar company, don’t fixate on that. Instead, focus on the old-fashioned approach: Build a high-quality product and exit at peak valuation.