What is loan management software? The path to greater profitability

From pre-qualification to repayment, a hefty part of the loan lifecycle could take ages if it wasn’t for specialized systems. Loan management software (LMS) offers a comprehensive platform to automate loan portfolio operations, ensure regulatory compliance, and personalize loan offerings.

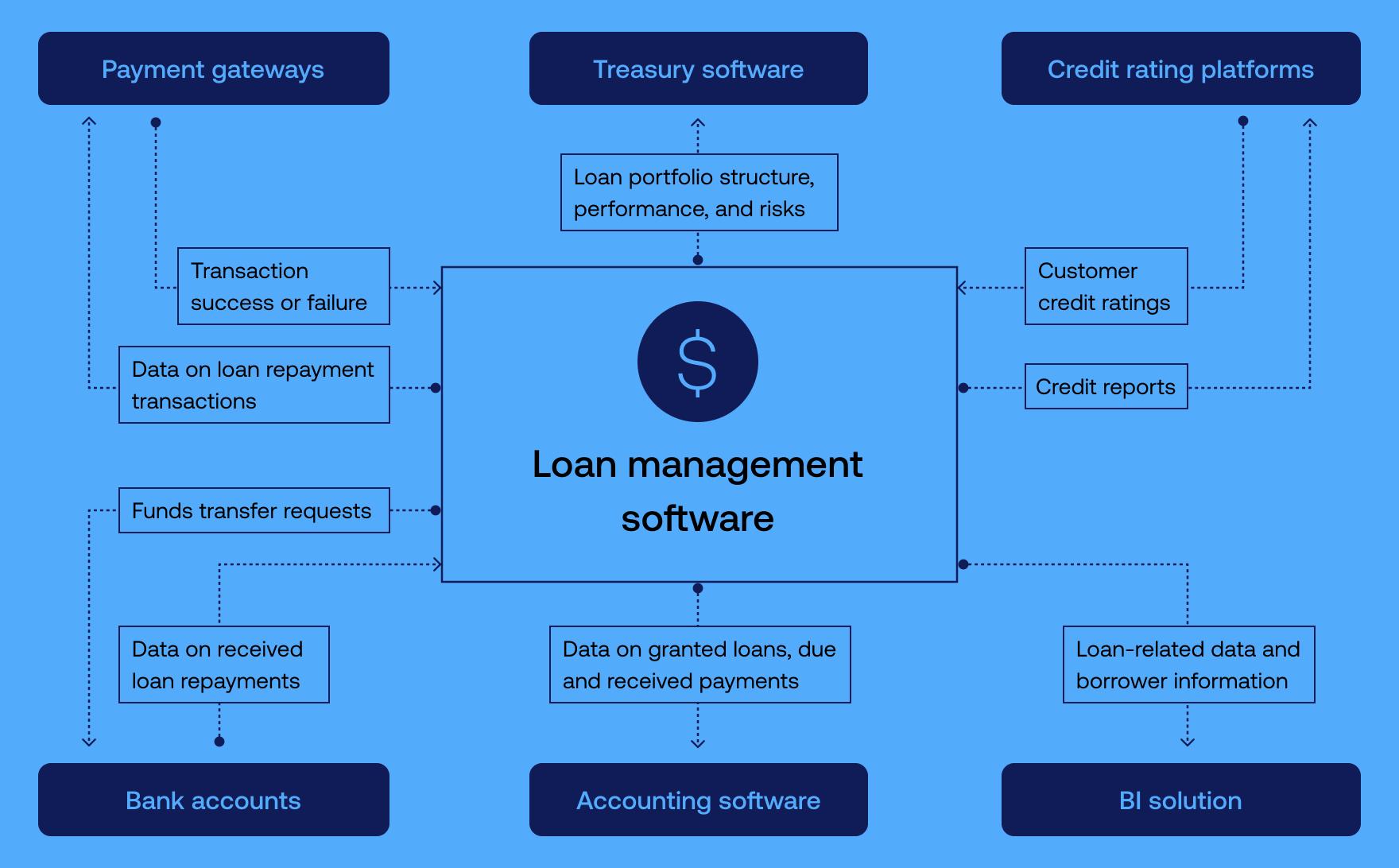

LMS streamlines data aggregation and analysis, seamlessly integrating with various existing systems such as accounting software, treasury management, payment gateways, and business intelligence (BI) solutions. This automated loan processing system is a surefire way to slash decision times from weeks to just 10-15 minutes and boost the average margins by an average of 50 percent.

Although it’s now standard for banks to employ LMS, technological advancements in big data, cloud computing, and AI analytics continue to enhance credit decision models. These innovations refine lending processes, accurately identify creditworthy applicants, and filter out unsuitable ones, ultimately increasing revenue.

Lending management software market in 2024 and beyond

The need for a simplified, accelerated, and overall effective lending process is growing and doesn’t show signs of slowing down.

01

In 2024, the global lending management software market is on the upswing, building on a robust foundation of $11.6 billion in 2023. According to forecasts by the IMARC Group, this market is expected to grow at a compound annual growth rate (CAGR) of 12.5 percent, reaching $34.3 billion by 2032.

This expansion is part of a broader shift towards digitalization, with nearly three-quarters of financial institutions switching to digital platforms to serve both new and existing clients.

Revenue

Revenue

Projected market size

Projected market size

02

Plus, the industry's investment in eContracting and eClosing technologies demonstrates a strong push towards innovative advancements, marking the beginning of an exciting new chapter in lending software development.

03

The market for loan management software — another crucial part of the modern financial landscape — valued at $5.9 billion in 2021 is also expected to soar to $29.9 billion by 2031 with a CAGR of 17.8 percent.

Revenue

Revenue

Projected Revenue

Projected Revenue

Key features of the loan management system

Modern loan management systems come with a range of functionalities aimed at improving the entire lending process, from loan origination to its modifications and restructuring.

Here’s a close-up of the important features of loan management software:

Loan origination

-

Automates the application process, including collecting applicant information, credit scoring, and initial decision-making.

-

Enhances underwriting by automating credit risk evaluation for faster, more precise loan approvals.

Customer relationship management

-

Consolidates customer information for improved management and tailored services.

-

Automates sending loan application forms, document submission reminders, and loan status updates.

-

Enables better lead tracking and nurturing.

Loan servicing

-

Manages all loan servicing aspects like payment processing, statement issuance, and escrow account management.

-

Offers resources for calculating interest rates, fees, and penalties to ensure accurate and timely financial management.

Document management

-

Manages loan documents, facilitating upload, storage, and access.

-

Ensures secure handling of sensitive borrower data.

-

Utilizes version control to avoid errors and maintain compliance through well-honed documentation practices.

Debt collection management

-

Streamlines debt collection with automated notifications, response processing, and enforcement workflows.

-

Segments debtors based on the amount owed, duration of the debt, repayment history, and risk profile, allowing for tailored collection strategies.

Payment processing

-

Supports various payment methods, including ACH, bank transfers, and card payments.

-

Automates the collection, allocation, and reconciliation of payments.

-

Incorporates security measures, such as encryption, SSL protocols, and PCI DSS compliance, to protect sensitive financial information.

-

Reduces the administrative burden on lenders.

Reporting

-

Offers detailed analytics for loan portfolio performance, tracking disbursements, repayments, and portfolio health.

-

Helps identify inefficiencies in the loan processing workflow.

-

Aids in competitive benchmarking and strategic planning by identifying emerging opportunities and threats.

Risk management

-

Evaluates the creditworthiness of borrowers by analyzing their financial history, credit scores, income, and expenses.

-

Adjusts loan conditions based on each borrower's risk.

-

Simulates different economic and financial scenarios to test the resilience of the loan portfolio.

The importance of customization in fintech lending software

Unique challenges call for unique approaches. While ready-made software for loan processing offers a set of basic features that might suffice for a few budget-minded financial institutions, it doesn't entirely meet the specialized operational processes, loan types, or integration demands of specific organizations.

Custom LMS

Off-the-shelf LMS

Customization level

Custom LMS offers unmatched flexibility, enabling deep customization to perfectly match your business processes and goals.

Comes with pre-packaged features, offering basic customization options that might not fully meet specific business requirements.

Scalability

Engineered to evolve with your business, a custom LMS is agile enough to accommodate growth or shifts in business strategies and objectives.

May face scalability constraints, limiting quick adaptation to market changes or new business models.

Integration capabilities

Crafted for seamless integration, custom LMS ensures complete compatibility with your existing tech stack and business operations.

Integrating an off-the-shelf LMS with existing systems may result in compatibility issues, undermining the overall system efficiency and requiring extra effort and money for adjustments.

Regulatory compliance

Tailored to meet industry-specific regulations, ensuring compliance with both local and global standards.

May only meet some specific regulatory requirements out of the box, requiring further adjustments or compromises on compliance.

Unique loan product support

Provides bespoke solutions that cater to niche markets or specific customer needs.

Provides generic loan management features, which may not support specialized products, affecting service versatility.

Competitive advantage

Propels the company ahead of the pack by offering exclusive features and capabilities.

Using a widely adopted system makes it challenging to differentiate your offerings in the market.

Customer experience

Elevates customer engagement through tailor-made interfaces and workflows.

Provides a standardized user experience that may only partially meet the expectations or preferences of all customer segments.

Reporting and analytics

Features advanced, customizable reports and analytics tools that answer particular strategic questions and support specific decision-making processes.

Comes with standard reporting tools that might not meet specific analytical or insight requirements.

Security and data protection

Includes top-level, tailor-made security measures to protect sensitive data, aligning with the highest data protection standards.

Offers basic security protocols, which may not fulfill rigorous data security needs.

Cost over time

While initial investments may be higher, the long-haul cost savings often outweigh early expenses.

Seems more cost-effective initially, but additional costs for licenses, extensions, and customizations can accumulate.

Support and maintenance

The cost and level of support depend on the agreement with the development partner or the in-house team's capacity. Potentially, personalized maintenance ensures the system’s optimal performance and alignment with your business needs.

Support is typically provided by the software vendor under the service level agreement, which may not address all unique operational issues.

Seize the benefits of custom loan management software with Vention

Tailored to specific needs

Custom loan management software development offers unparalleled flexibility and customization. From adjusting field types to integrating data, our lending software development company tailors every feature to fit your unique lending processes.

Scalability

Our team builds your loan processing system with future growth in mind, making it effortlessly adaptable to your evolving needs.

Improved efficiency and productivity

From automated payment collection to creating clear segmentation rules, our custom software enables organizations to capitalize on more market opportunities, approve more loans, and redirect resources toward strategic activities.

Competitive edge

For both emerging and seasoned lenders, driving lending growth can be challenging. Simplifying the loan application journey and providing personalized customer experiences can elevate your institution above the competition.

Smooth integration with existing systems

Custom LMS software plugs seamlessly into your existing infrastructure, making integrations with accounting software, customer relationship management (CRM) systems, and other tools an easy lift. Full compatibility enhances data flow, reduces duplications, and improves data consistency across your organization.

Cost-effectiveness in the long run

Custom loan management software may require substantial upfront investment, but often pays off in the long run. No licensing fees, costly subscription fees, or software customization overhead — tailored LMS solutions increase ROI up to 500 percent.

Transform your business with custom loan processing software.

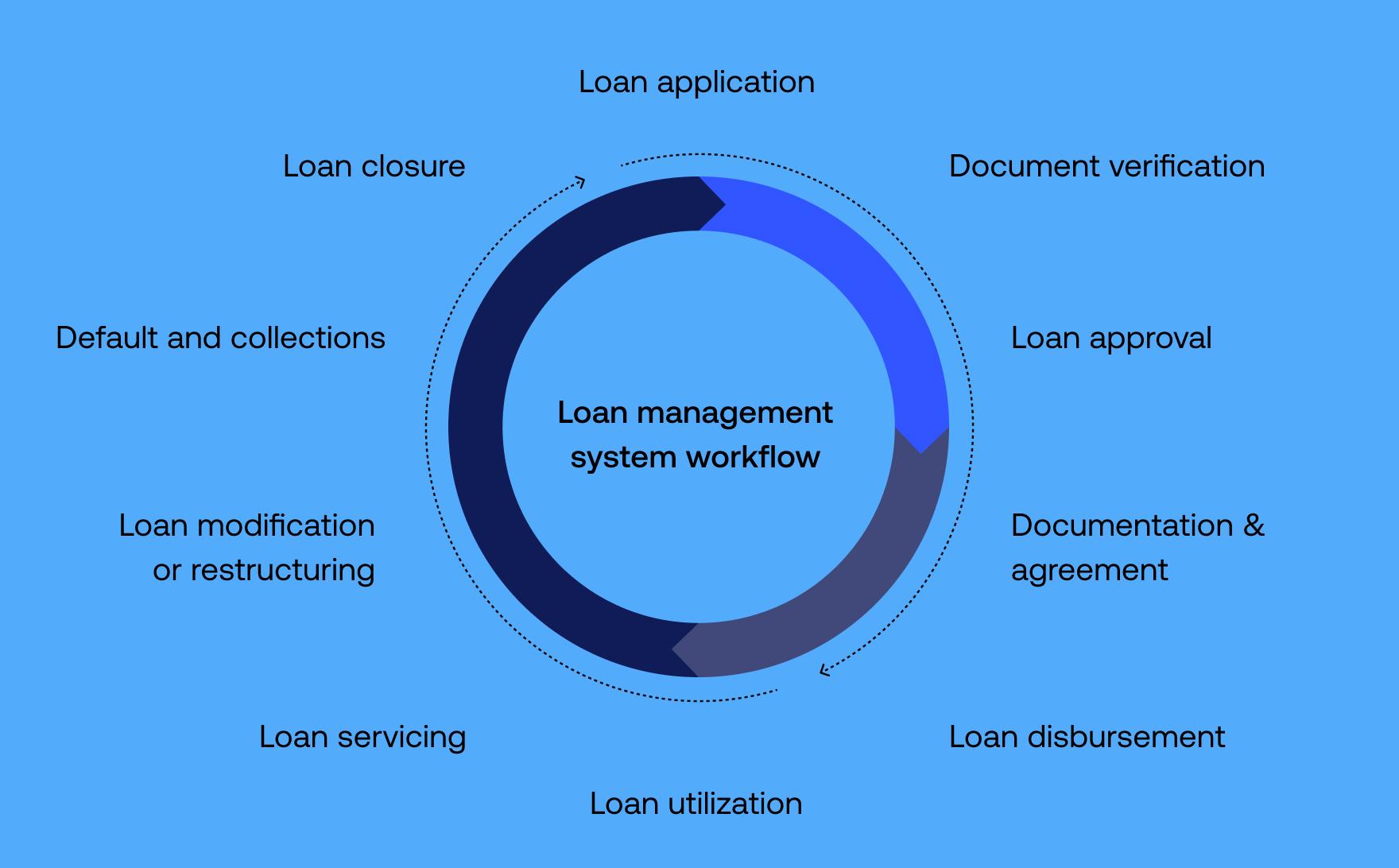

Loan management system workflow

Our custom lending management software automates the critical steps of your loan processing workflow for a faster, more transparent, and fully regulatory-compliant process.

Loan origination

Application: Borrowers submit loan applications via online forms, in-person visits, or phone calls, providing personal, financial, and employment details.

Assessment: The LMS automatically evaluates the borrower's creditworthiness using credit scores and financial history.

Approval: Following specific criteria, the system decides on the loan application's approval or rejection. Approved applications result in generated loan terms and conditions.

Document management

Documentation: Required loan documents, including loan agreements, are automatically generated by the system and sent to borrowers for signature.

Verification: The system checks returned papers for accuracy and completeness.

Loan disbursement

After document verification, the loan amount is electronically deposited to the borrower’s account.

Loan servicing

Payments management: Automates the processing of monthly payments, including updates to the loan balance.

Borrower support: Offers access to loan information and a communication channel for inquiries or concerns.

Collections management

Based on set rules, the system manages overdue payments by automatically sending reminders and escalating cases as needed.

Risk management

Continuous risk assessment is performed throughout the loan's life, adjusting parameters based on real-time data analysis.

Closure or refinancing

The system marks loans as closed upon full repayment. For borrowers seeking refinancing, the process can restart with new loan terms.

Loan management system requirements

Well-established requirements are the cornerstone of every successful lending software development project.

Accordingly, before opting for lending software development services, identify and document the system’s functionalities, features, and constraints — essential for meeting your business goals and regulatory compliance needs.

LMS evaluation checklist

Technical and operational constraints

- Cloud vs. on-premises deployment options

- Infrastructure requirements (servers, storage, network)

- Strategies for migrating existing data

- User and administrator training programs

- Plans for customer support and system maintenance

Business objectives

- LMS aligns with the overarching business strategy and goals

- LMS supports anticipated growth and scalability

- LMS adheres to both local and global regulatory standards

Functional requirements

Loan origination

- Automated application processing

- Credit scoring and risk integration

- Document management for applications

- Approval workflow management

Loan servicing

- Payment processing (EMIs, one-time payments, prepayments)

- Interest recalculations

- Account statement issuance

- Payment and due date notifications

Customer management

- CRM integration

- Online loan management portal

- Multi-channel communication (email, SMS, phone)

Risk management

- Credit bureau integration

- Collateral oversight

- Default management procedures

- Provisioning strategies

- Write-off protocols

Reporting and analytics

- Customizable reports

- Loan portfolio dashboards

- Risk assessment analytics

- Compliance reporting features

Non-functional requirements

Performance

- Established benchmarks for user response times

- Specified criteria for transaction processing speeds

Scalability

- Scalability for future growth in customers and transaction volume

Security

- Data encryption in transit and at rest

- User authentication and authorization

- Audit trails and logging for compliance and monitoring

Integration

- API integration with external systems (banking, credit bureaus, etc.)

- Efficient data importing and exporting capabilities

Usability

- Responsive design for web and mobile

- Intuitive user interface and navigation

- The system meets accessibility standards, such as the Web Content Accessibility Guidelines (WCAG)

Best practices for establishing your LMS criteria

Gather stakeholder input

Include representatives from all user groups (loan officers, underwriters, accountants, IT professionals, and borrowers). Use interviews, focus groups, brainstorming sessions, surveys, and workshops to gather input on the core needs, pain points, and expectations.

Define business objectives

Ensure the automated loan processing system supports the organization's overall business strategy, growth objectives, and customer service goals. Analyze the legal and regulatory framework to elicit requirements that the system must comply with, such as GDPR for data protection and local financial regulations.

Specify functional requirements

-

Loan origination: Define the stages of the loan origination process, from application submission and underwriting to fund disbursement.

-

Loan servicing: Outline requirements for billing, payment processing, interest calculation, statement generation, and customer notifications.

-

Customer management: Include CRM features, customer portals, communication tools, and support for managing customer information and interactions.

-

Risk management: Detail requirements for risk assessment tools, credit checks, collateral management, and provisions for loan defaults.

-

Reporting: Specify reporting capabilities, dashboard needs, analytics features, and compliance reporting requirements.

Outline non-functional requirements

Determine both client- and server-side metrics for performance and outline scalability plans for user growth, transaction volume, and data storage expansion. Implement necessary security measures — data encryption, user authentication, and authorization levels — and analyze the need for robust security mechanisms such as AI-based fraud detection.

List necessary integrations with internal and external systems, choosing the best integration techniques for each. Establish usability standards, focusing on optimal user interface (UI) design and adherence to accessibility regulations.

Assess technical and operational constraints

Choose a hosting solution for the LMS and determine necessary infrastructure needs. For legacy system upgrades, develop a data migration plan.

Also, don’t forget to identify training requirements for various user groups and post-launch support expectations.

Prioritize requirements

Identify must-have loan management software features based on your business needs, budget, and timelines. When prioritizing features, assign the highest priority to non-negotiable functionality, while nice-to-have features can be put on the back burner.

Documentation and validation

Document all requirements' context and strategic relevance for future reference and assessment. Have key stakeholders evaluate the requirements document for thoroughness and precision before giving their final consent.

Need help with defining loan management system requirements?

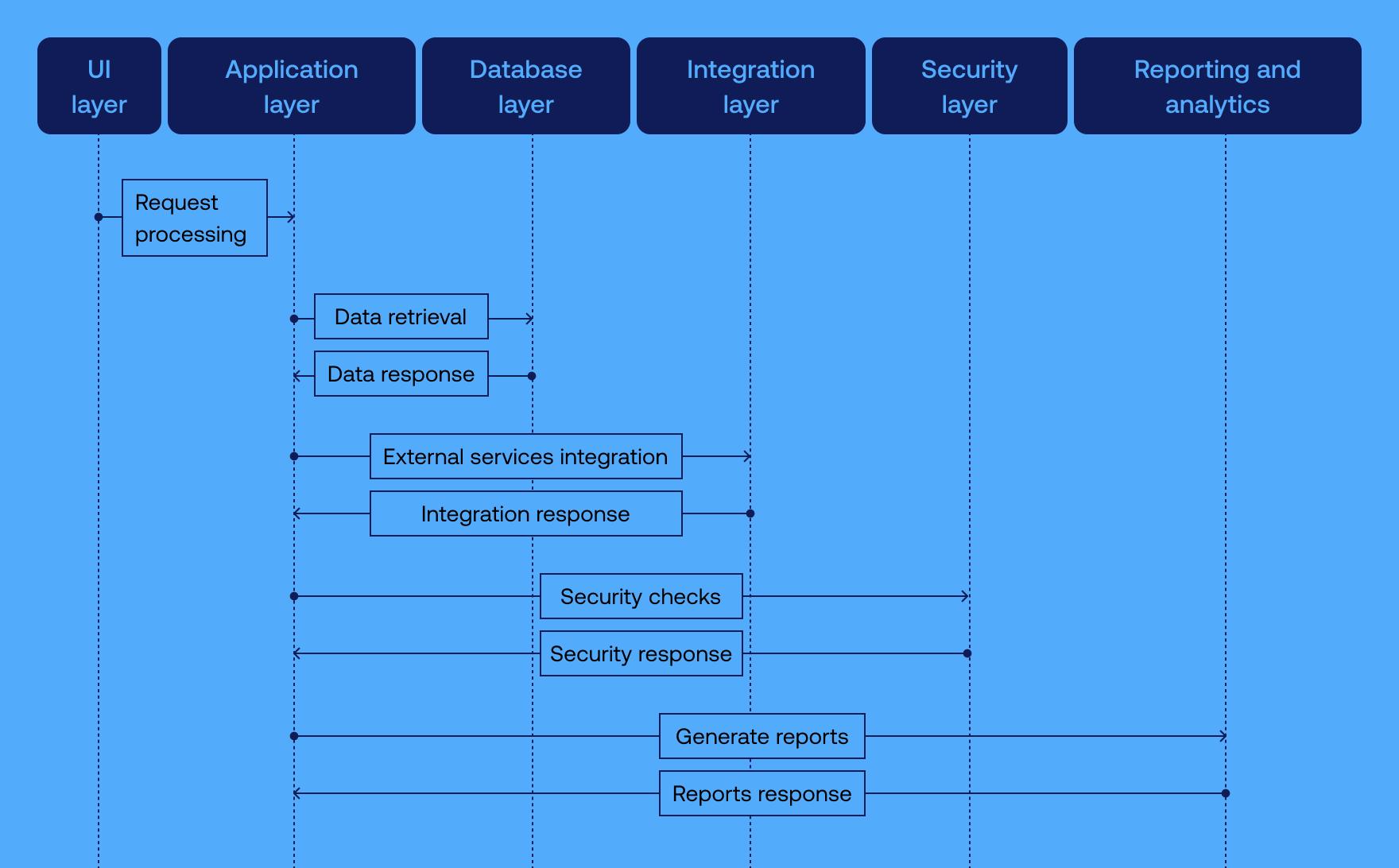

Loan management system architecture

Building a strong loan management system begins with a robust blueprint. Our lending app software development company puts a well-balanced architecture at the core, ensuring it fits your unique requirements, technology choices, and scalability needs.

Key сomponents of our loan management system architecture

UI layer

The UI layer serves as the frontend interface for lenders (such as administrators and loan officers) and borrowers (or customers). It encompasses web pages or mobile app interfaces for account management, loan application, document upload, loan tracking, and communication.

Application layer (business logic)

The application layer handles loan application processing, risk assessment, credit scoring, approval workflows, and interest calculations. This layer also integrates with external systems for credit checks and verifications.

Database layer

The data tier stores all data related to loans, users, transactions, and historical records. This layer usually includes a relational database management system (RDBMS) for structured data and NoSQL databases for unstructured data like documents and logs.

Integration layer

The integration layer facilitates communication between the LMS and external services, such as credit bureaus, payment gateways, banking systems, and regulatory compliance tools. This layer connects to other systems through APIs or messaging protocols.

Security layer

Functioning as a protective shield, the security layer ensures data privacy, integrity, and security through authentication, authorization, encryption, and compliance with regulations like GDPR or CCPA. It also features secure data transmission and storage mechanisms and regular security assessments.

Reporting and analytics

This component offers reporting capabilities and dashboards for tracking loan portfolios, gaining customer insights, financial analysis, and measuring operational performance. It might also feature data analytics and machine learning tools for risk assessment.

Our development process for custom loan management software

Planning and analysis

-

Requirement gathering with stakeholders

-

Market analysis and user demand research

-

Compliance and regulatory analysis

-

Requirement prioritization by business impact and technical complexity

System design

-

System architecture design (tech stack, databases, cloud vs. on-premises, etc.)

-

UI/UX design for optimal ease of use for both internal and external users

-

Blueprint creation for data structures, system workflows, and integration plans

Development

-

System implementation in iterative cycles, prioritizing core functionalities

-

Custom feature development for loan origination, risk evaluation, and reporting processes

-

External system integration (e.g., credit bureaus, payment platforms, financial institutions)

-

Legacy data transition plans if necessary

Testing

-

Conducting various types of testing (unit, integration, and system testing) in parallel with coding

-

User acceptance testing to ensure the application behaves as expected

-

Issue and defect resolution

Deployment

-

Production environment setup, including data backup, recovery strategies, and security protocols

-

Phased system deployment to mitigate risks

-

System monitoring for any immediate issues

Training and documentation

-

Creation of comprehensive user manuals and documentation

-

Training sessions for user adoption

Maintenance and support

-

Setup of tiered customer support (L1/L2/L3) for swift issue resolution

-

Regular feature updates and security enhancements

-

Continuous system monitoring to meet changing business needs

Cost of loan management software development

The development cost for custom loan management software varies based on the solution’s complexity, the intricacy and number of features and integrations, the sourcing model, and the project's duration.

Here’s the approximate development cost of loan management software at Vention:

Small to mid-sized project

Large-scale project

Maintenance & upgrades

Additional costs

Infrastructure: Hosting, data storage, and operational costs depending on whether the system is on-premises or cloud-based.

Third-party services: Fees for integrating external services or data sources.

Training and Implementation: Costs to train staff and deploy the system within your operations.

Vention is a top-tier loan management software development company

We’ve lent our expertise to hundreds of financial institutions, delivering intuitive user interfaces, secure transaction systems, and scalable backend architectures.

Custom consumer lending software

-

Microfinance lending

-

POS lending

-

PayDay lending

-

Auto lending

-

Mortgage lending

-

Healthcare lending

-

Student lending

Commercial & business lending software

-

Leasing

-

Peer-to-peer lending

-

Merchant cash advance

-

Bank lending

-

Factoring

-

Working capital finance

-

Trade finance software

Fintech consulting services

-

Technology selection and advisory

-

Requirements definition

-

Business specifications

-

Design support

-

Requests for proposals

-

Fintech software modernization

Our clients say it best

At Vention, our success in smart contract development reflects our enduring partnerships. Here's what our clients say on Clutch.co.

Why choose us

Expertise and experience

With two decades in the market, Vention boasts a roster of 3,000+ seasoned engineers who have contributed to the success of 500+ esteemed clients across multiple sectors.

Dedicated team model

Our clients enjoy the benefits of a dedicated team approach that accelerates product launches, fuels growth, and fosters ongoing innovation.

Adaptability and scalability

Vention's model is designed for adaptability and scalability, as you can efficiently scale your team up or down to match project needs.

Global experts, local times

Our staff augmentation model links you to top talent from 16 hubs worldwide — all operating within your time zone.