AI solutions for insurance

Which challenge is at the top of your mind right now?

- Cutting costs

- Speeding up claims

- Delivering more personalized products

- Or all three?

The timing couldn’t be better: AI in insurance by Vention can solve all of them.

With 20+ years in software engineering and over 3,000 specialists worldwide, we’ve built AI-driven systems for Fortune 500 companies and fast-growing startups.

Our teams pair deep insurance expertise with technical excellence in gen AI, computer vision, natural language processing (NLP), and system integration. We design secure and scalable custom AI solutions that bring efficiency and clarity to even the most complex insurance workflows.

ROI metrics for AI in insurance

Yes, we understand: ROI rules the game. Your peers are clear on what they expect, though timelines often vary.

Ninety-nine percent of all insurers are investing in or exploring GenAI, with top priorities including productivity (53 percent), cost reduction (52 percent), and new revenue (51 percent). Two-thirds expect revenue growth of more than 10 percent from AI in core functions. At the same time, 58 percent of CEOs believe those gains may take three to five years to materialize. Despite strong leadership support, one-third of companies acknowledge that execution still lags behind AI strategy.

Proven performance metrics show the impact of artificial intelligence in the insurance industry. Insurers report up to 80 percent faster claims approvals, 50 percent lower administrative overhead, and onboarding costs down by 40 percent.

Advanced underwriting systems have reduced decision cycles by 90 percent. Predictive analytics has improved fraud detection rates by 28 percent, and machine learning has increased underwriting accuracy by 54 percent.

On the customer side, 42 percent of service interactions are now AI-driven, and nearly half of insurers use real-time pricing models for fairer, more precise premiums.

AI-driven efficiency across insurance

Speed. Fairness. Accuracy. These are the pillars of modern insurance. AI solutions in the insurance industry deliver them by removing bottlenecks, improving risk modeling, and streamlining services.

Below, we break down core use cases (underwriting, pricing, claims and fraud management, and customer engagement), showing how they play out across different insurance types.

Underwriting

AI transforms underwriting by making risk evaluation faster, sharper, and less disruptive for customers.

- Life and health: Smart predictive models sift through medical records and wearables’ readings, which accelerates underwriting and often eliminates the need for a medical exam.

- Property: Computer vision and geospatial analytics help assess property conditions from photos, drone footage, and satellite imagery.

- Casualty: Machine learning mines contracts, operations, and past claims to forecast liability exposure.

- Auto: Telematics and behavioral analytics reveal real-world driving patterns, like sudden stops, gentle braking, and monthly mileage.

- Commercial: AI evaluates operations, historical accidents, and employee profiles to reveal liability and safety hazards.

- Specialty: Sector-specific models assess complex exposures in marine, aviation, energy, or cyber markets.

Pricing

Artificial intelligence in the insurance sector reworks premiums to mirror individual risk, not broad averages.

- Life and health: Longevity forecasts fine-tune life policy pricing, and lifestyle-based data adjusts health premiums.

- Property: Algorithms weigh property condition, location hazards, and historical loss data for fairer premiums.

- Casualty: AI incorporates industry benchmarks, jurisdictional trends, and real-time loss experience to set liability premiums.

- Auto: Usage-based models tie premiums directly to driving habits, rewarding safe drivers.

- Commercial: Models adjust rates using benchmarks, workforce size, and geographic exposures.

- Specialty: Machine learning incorporates global loss data, regulations, and scenario modeling to reflect volatile risks.

Claims management

AI in the insurance sector accelerates claims handling while reducing disputes.

- Life and health: NLP validates information from medical reports and death certificates for faster payouts.

- Property: Image recognition confirms property damage caused by storms or accidents. Machine learning automates the reviews of repair estimates.

- Casualty: NLP processes incident reports, witness statements, and legal filings to resolve liability claims faster.

- Auto: Computer vision evaluates accident photos/videos to estimate repair costs and confirm damage.

- Commercial: Automated document processing speeds up workers’ compensation and property-related claims.

- Specialty: NLP accelerates review of technical documentation and compliance records tied to large-scale claims.

Fraud detection

Advanced analytics provide an additional layer of protection for insurers and policyholders by identifying fraud before it escalates.

- Life and health: AI flags anomalies such as duplicate claims, fabricated death certificates, or unusual billing.

- Property: Algorithms detect inflated repair costs, duplicate submissions, or falsified evidence.

- Casualty: Analytics uncover staged accidents, exaggerated injuries, or conflicting testimonies.

- Auto: AI models detect red flags like staged collisions, inflated invoices, or mismatched damage data.

- Commercial: AI detects inflated workers’ comp claims or misclassified risk submissions.

- Specialty: Models identify falsified cargo manifests, irregular cyber-incident reporting, or niche-market anomalies.

Customer engagement

AI ensures insurance interactions are transparent and supportive at every stage.

- Life and health: Virtual assistants guide beneficiaries through sensitive claim filings while offering health policyholders real-time coverage and preventative care recommendations.

- Property: Claim assistants help homeowners and businesses file losses, upload documents, and track status in real time.

- Casualty: Digital tools explain complex liability claims and provide timely updates.

- Auto: Virtual assistants guide drivers through accident reporting, photo uploads, and claim progress.

- Commercial: HR managers and business owners receive step-by-step claim support with real-time updates.

- Specialty: Digital assistants clarify highly technical policies and claims.

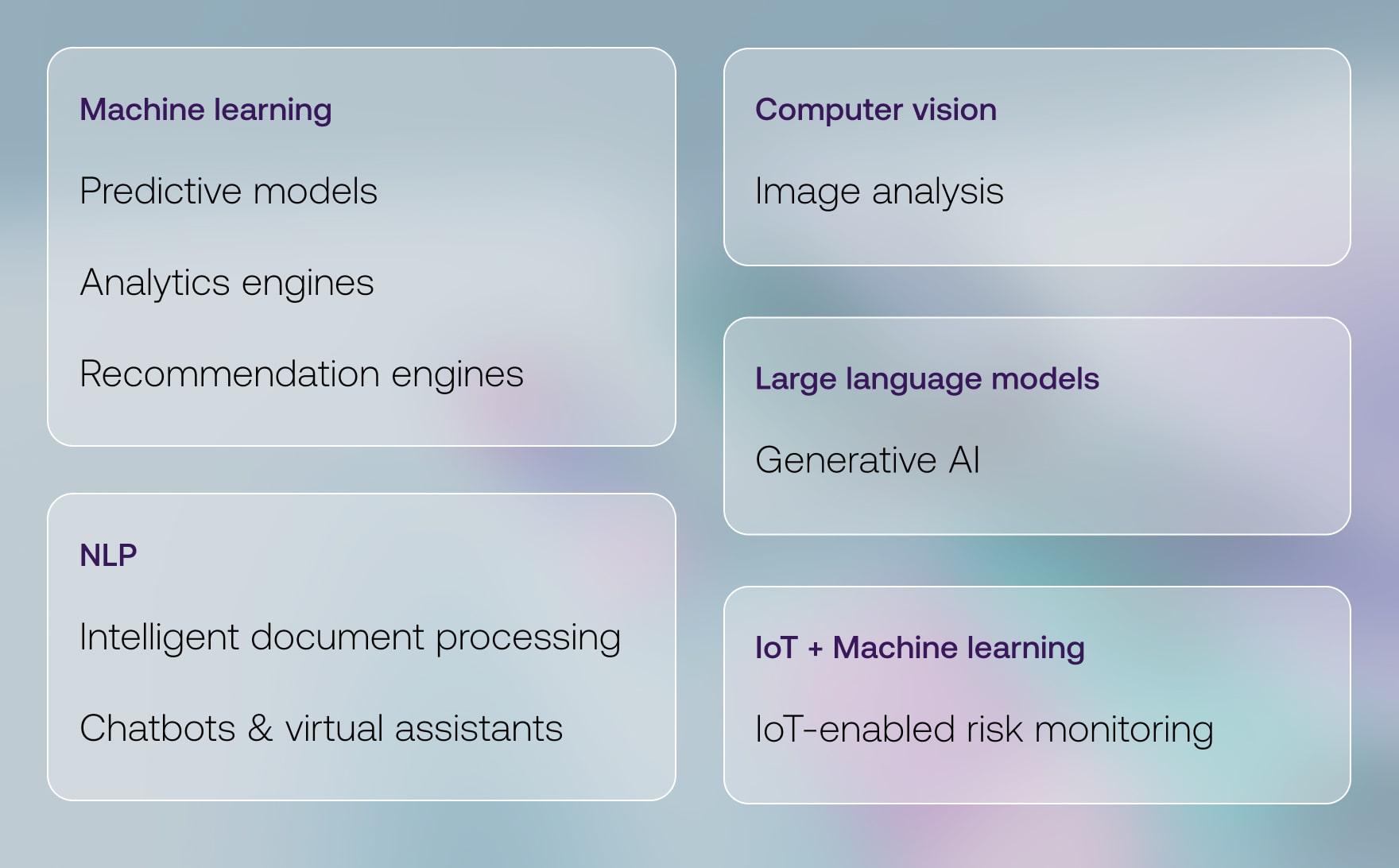

AI solution types and feasibility factors

Every insurance use case depends on a specific kind of solution. Understanding which type fits the need is essential for gauging feasibility, planning integration, and ensuring the model can scale.

The table below maps the most relevant building blocks to their insurance applications, along with the key factors that shape successful deployment.

Technology under the hood

Key applications in insurance

Technical feasibility considerations

Predictive models

Technology under the hood

Machine learning

Key applications in insurance

- Risk scoring

- Dynamic pricing

- Loss forecasting

- Fraud pattern recognition

Technical feasibility considerations

- Historical datasets

- Strong data pipelines

- Continuous retraining for accuracy and compliance

Analytics engines

Technology under the hood

Machine learning

Key applications in insurance

- Real-time risk monitoring

- Portfolio performance tracking

- Operational leakage analysis

Technical feasibility considerations

- Scalable infrastructure

- Streaming data processing

- Robust access controls

Recommendation engines

Technology under the hood

Machine learning

Key applications in insurance

- Personalized policy matching

- Preventive health nudges

- Optimal claims settlement or repair path suggestions

Technical feasibility considerations

- Clean customer data

- Feedback loops for refinement

- Safeguards against biased outputs

Intelligent document processing

Technology under the hood

Natural language processing + optical character recognition (OCR) for digitized documents

Key applications in insurance

- Claims document review

- Regulatory compliance checks

- Knowledge extraction

Technical feasibility considerations

- Secure handling of sensitive data

- Explainability in automated decisions

Chatbots and virtual assistants (conversational AI)

Technology under the hood

Natural language processing

Key applications in insurance

- 24/7 policyholder support

- Guided claim submission

- Agent knowledge assistance

Technical feasibility considerations

- Integration with CRM, claim management, or other relevant systems

- Secure communication

- Mastery in domain-specific language

Image analysis

Technology under the hood

Computer vision

Key applications in insurance

- Property and auto damage assessment

- Accident reconstruction from crash photos

- Fraud detection from image/video anomalies

Technical feasibility considerations

- High-quality labeled imagery

- Integration with claim workflows

- Human-in-the-loop review for uncertain cases

Generative AI

Technology under the hood

Large language models (LLMs)

Key applications in insurance

- Drafting policies

- Summarizing claims

- Automating standard correspondence with customers

Technical feasibility considerations

- Output accuracy

- Regulatory compliance

- Controlled use of sensitive customer information

IoT-enabled risk monitoring

Technology under the hood

Internet of things (IoT) + machine learning

Key applications in insurance

- Telematics-based auto premiums

- Predictive maintenance alerts for vehicles and property

Technical feasibility considerations

- Secure data transmission pipelines

- Reliable IoT infrastructure

- Real-time AI processing at scale

Not sure where AI fits into your workflows?

If you're still exploring how AI could support your insurance workflows, a workshop is a practical first step. We'll assess your current processes, identify promising use cases, and evaluate what’s technically feasible.

Vention’s insurance projects

Our experience in insurance shows how we can turn complex workflows into scalable, intelligent solutions. By combining technical know-how with industry insight, we’ve helped insurers streamline claims, reduce costs, and improve customer experiences.

Case study

motum (by RepairFix)

For a SaaS platform that manages vehicle claims and routine maintenance, we added intelligent features, automation, and expanded functionality to support long-term growth. After deployment, the system efficiently managed over 8,000 vehicles and tens of thousands of claims.

A CPTO at motum highly spoke of our partnership: “What I like about our cooperation is the speed of implementation, the high level of expertise of the engineers and Vention's excellent account management. I recommend the company to the market.”

Wagmo

We collaborated with Wagmo, a pet insurance provider, to build a dedicated app that centralized systems, streamlined plan management, and improved client onboarding. This included integration with multiple payment processors. Following the launch, Wagmo’s active user base grew from 50 to over 4,500.

Technology is already transforming how insurers handle claims, detect fraud, and tailor their offerings. With our proven track record in building secure, scalable systems, we help insurers achieve measurable efficiency gains and cost savings.

Quick facts about Vention

Years of experience delivering custom software for insurers, from pet insurance apps to large-scale claims platforms

Successful AI projects (and counting) with flexible architectures to adapt and grow with your needs.

5-star reviews from clients like CoverWallet

AI experts ready to jump-start within 2 weeks

ISO 27001-certified for security

Continuously recognized for growth and innovation

How we can help

We design our insurance AI development services around the outcomes that matter most to insurers: lower costs, faster cycles, and more accurate decisions. At the same time, we ensure every solution is transparent in operation and scalable for the future. True peace of mind comes from this balance: efficiency paired with reliability, trust, and adaptability.

Find high-ROI opportunities before you invest

Our AI discovery workshops are tailored to identify the most promising use cases, validate feasibility, and build a clear adoption roadmap, so you don’t waste time or budget at later development stages.

Launch new solutions with speed and precision

From underlying AI models to enterprise insurance platforms, we build custom AI-driven solutions that are secure, scalable, and tailored to your needs.

Turn legacy systems into modern assets

We enhance existing insurance apps with automation, AI-powered features, and integrations, extending their lifespan and achieving efficiency previously out of reach.

Get more accuracy from the models you already have

We fine-tune and optimize AI models for fairness, compliance, and speed, turning underperforming experiments into reliable production tools.

Connect AI seamlessly to what you already use

Through robust APIs and secure data pipelines, we integrate AI with your claim management, policy admin, or CRM platforms without disrupting workflows.

Empower your teams with support and training

From claims adjusters to underwriters, we help every department adopt new systems smoothly and maximize their value.

Whether you’re exploring, modernizing, or scaling, our service packs let you choose exactly what your business needs. Start with one or combine them for a full transformation.

How we build custom AI solutions for insurance companies

Every insurer’s priorities are different. That’s why we don’t offer one-size-fits-all products. Instead, we design and deliver custom systems tailored to your portfolio and workflows.

Discovery

We start with a discovery workshop to assess your current workflows, data maturity, and goals. This produces a roadmap that balances quick wins with long-term scalability.

Data strategy and preparation

Strong data foundations are essential. We help you identify and integrate the right internal and external sources.

- Internal sources: Historical claims files, policy records, underwriting notes, CRM data, call transcripts, and telematics feeds.

- External sources: Third-party datasets such as demographic information, credit scores, medical networks, weather data, and geospatial imagery.

Our teams build secure pipelines that merge these streams into a consistent dataset. We also clean, normalize, and anonymize data where needed so your models are trained on reliable, high-quality datasets that meet regulatory requirements.

Implementation

We often begin with an MVP to validate feasibility and ROI, then iteratively develop full-scale systems with strong APIs and seamless integrations.

Clients usually approach us not just to build a model but to revamp or create a full insurance solution. Our team of 3,000 experts covers every capability required: backend, frontend, mobile, DevOps, and security.

We design models that reflect ethical principles and include bias monitoring and retraining protocols to ensure ongoing fairness.

Since sensitive financial, medical, and personal data requires maximum protection, we embed encryption, role-based access, and monitoring tools from the start.

Deployment and launch

We integrate models into your core systems through APIs and secure data connectors. This enables real-time updates on claims or policy changes, while your team benefits from tools that complement, not disrupt, existing workflows.

Solutions only deliver value when used effectively. That’s why we offer training for underwriters, adjusters, and support staff, so they know how to work with these systems and trust their outputs.

Continuous monitoring and retraining

As the market evolves, so should your systems. We build monitoring dashboards to track key metrics like claims cycle times, pricing accuracy, and fraud detection rates.

Your systems are retrained regularly to reflect new data trends, ensure fairness, and maintain performance.

AI implementation challenges in insurance

AI in insurance is about aligning systems, people, and processes. Below are the top challenges insurers face, and how we can help overcome them.

FAQs

Which parts of our claims processing can realistically be automated with AI?

AI can take over repetitive, rules-based tasks such as document review, damage validation, and payment routing. These automations reduce manual effort and help accelerate claims cycles.

Can AI really help us personalize insurance products for our customers?

Yes. By examining behavior, demographics, telematics, and interaction data, AI solutions for insurance organizations provide tailored premiums, coverage add-ons, and even proactive risk-prevention suggestions.

How long does it usually take to implement AI solutions for insurance?

Timelines vary by scope. A minimal viable product (MVP) for claims automation may deliver initial results in 3–6 months. Full-scale deployments typically range from 9 to 18 months, depending on integration complexity and use case maturity.

How do you keep AI systems accurate and reliable after deployment?

We implement monitoring dashboards, feedback loops, and retraining mechanisms to ensure the AI system adapts to new data patterns, regulatory updates, and fraud behaviors without compromising performance.

What kind of investment should we expect for custom AI solutions?

Costs depend on the scope. A focused MVP typically requires a smaller investment, whereas a full-scale insurance platform necessitates more extensive development and integration. We offer clear estimates upfront. If you would like a tailored preliminary quote, feel free to use our free online calculator or contact us directly.